‘Demonetisation didn’t impact even 0.001% of black money’

‘In the total of black wealth, only 1% or less than 1% constitute cash.’

‘So, even if cash is completely weaned out, it impacts only 1% of the black wealth.’

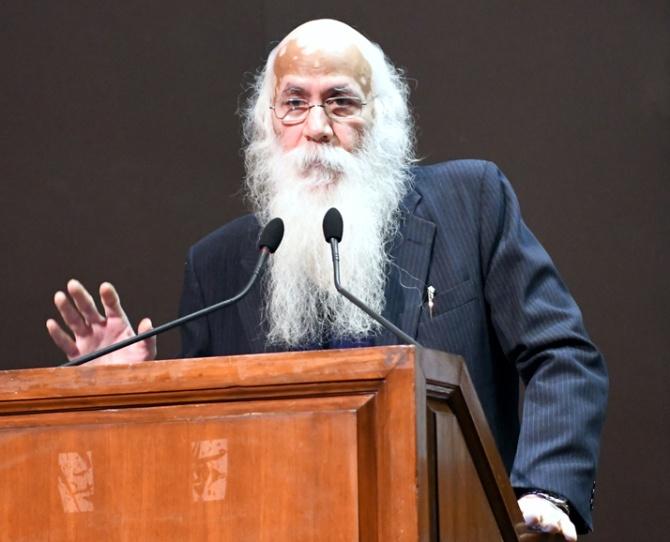

Professor Arun Kumar, the Malcolm Adiseshiah Chair Professor at the Institute of Social Sciences has been a strong critic of demonetisation from the day Narendra Damodardas Modi unleashed it on people on the 8th of November, 2016.

His book released soon after that, Demonetisation and Black Money questions the rationale behind what the prime minister did on India.

Five years down the line, Professor Arun Kumar reiterates what he had said in 2016!

“Cash in the economy has little to do with black income generation,” he tells Rediff.com‘s Shobha Warrier. The first of a two-part interview:

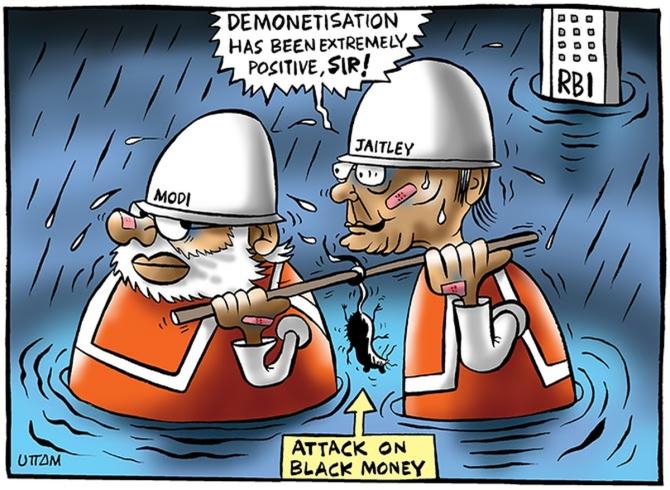

In 2016, when Narendra Modi thrust demonetisation on people, the argument of the government and its supporters was that it would flush out black money and reduce cash circulation.

Five years down the line, it is reported that cash in circulation now is at a record 14.5% of GDP.

Demonetisation was based on the premise that ‘black means cash’. That itself is a mistake; that black does not mean cash. Cash is only a part of our wealth.

In the total of black wealth, only 1% or less than 1% constitute cash.

So, even if cash is completely weaned out, it impacts only 1% of the black wealth.

Though the RBI said, 99.3% of demonetised cash came back after demonetisation, 100% of the cash came back since we know where the balance 0.7% was held. It means not even 0.001% of the black wealth was impacted.

The second aspect of the black economy is black income generation.

How do you generate black wealth? You first earn black income and out of that you save a part and that becomes your black wealth.

Suppose you are a doctor and you see 50 patients but declare the fees paid by 30. What the 20 people pay you becomes your black income.

So, black income is generated by what is called under-invoicing. Similarly, there is also over-invoicing to generate black incomes.

You are saying black income need not be in the form of cash alone.

Yes. You must distinguish between wealth and income.

Income is what you earn every day through your activity, and wealth is what you accumulate over a period of time.

Income is flow, but wealth is stock. And the stock is different from the flow.

We should not confuse between stock and flow.

So, black income generation is different from black wealth. And cash is less than 1% of black wealth.

Black wealth is generally accumulated in the form of…?

Different kinds, in the form of undervalued real estate, gold, under invoiced inventories, capital held abroad, etc.

Just as white wealth is held as a portfolio of assets in bank deposits, shares, etc, black wealth is also held as a portfolio asset.

But only a minimum amount is held as cash since it does not give a return.

That’s why my argument is, of the Rs 300 lakh-Rs 400 lakh crores of black wealth at that time, only Rs 3 lakh-Rs 4 lakh crores would have been in the form of cash.

And the Rs 3 lakh-Rs 4 lakh crores came back. It means you could not demobilise any of the black cash.

And you did not stop the black income generation because the doctor continued to declare only 30 out of 50, and the businessman continued to under-invoicing.

Next, different countries have a different ratio of cash to GDP.

For instance, Nigeria, where corruption is high, has only 1.4% of GDP as cash whereas in Japan, considered an honest country, it is 18%.

Sweden, another country with negligible black income generation, has 1.4% of GDP as cash which is the same as Nigeria.

So, you cannot say that where there is more cash, there is more black income generation.

India had a 12% cash-GDP ratio when demonetisation happened and now it is 14.5%. But that is not an indication that there is more or less black income generation.

Cash in the economy has little to do with black income generation — there are other factors.

But the government connects black money, black economy and corruption…

Corruption is a different thing. Corruption involves illegality and a quid pro quo.

Like, you do something for me, and I give you something in return, in cash or kind as a quid pro quo.

When you talk about the doctor who sees 50 patients but declares only 30 or a teacher who does not declare the tuition income or a businessman who does under and over-invoicing, there is no quid pro quo.

A large part of the black economy has no quid pro quo. It results in an extra income.

So, corruption is not coterminous with the black economy.

Do you mean, you cannot connect black money, black economy and corruption?

Corruption is one part of the black economy and not the whole of the black economy. But they are interlinked.

The more corruption, the more black income generation.

If you want to bribe someone, you can bribe in white, like the election bonds where you can pay political parties in white for some work done.

You can also bribe by transferring shares or real estate at less than the real price.

If a property is Rs 50 crore but you transfer it to someone for Rs 5 crore, it is a bribe in white.

So, black income generation does not mean it involves only cash. This is a fatal mistake.

Unfortunately, the public also believes that ‘black means cash’.

So, the public accepted the idea that demonetisation was for catching the black money of rich people.

The poor people thought even though they were badly affected by demonetisation, the ill-gotten wealth of the rich would be impacted! So, justice was being meted out finally.

That’s because they didn’t realise the difference between black income, black economy and corruption.

I must say even many economists did not understand that.

Your famous quote then was, demonetisation was like taking 85% blood out of somebody’s body…

What is cash? Cash is not something we eat. You go to a shop, pay cash to buy food.

The shopkeeper gives it to the wholesaler and s/he, in turn, passes it to the manufacturer who then pays the workers.

So, cash is used for transactions to circulate incomes.

Each time you do a transaction, you generate an income.

It can be done through real cash, or debit card or credit card or electronically. These are all forms of money.

When in an economy, money becomes short, transactions become difficult and income generation slows down.

That’s why I said, if you take out 85% of blood from somebody’s body, the body will not get any nutrition as blood supplies nutrition to the body. Then the body will collapse.

Similarly, if you take out 85% of the currency from the economy, especially because our unorganised sector works in cash, it will start to collapse. And it did so.

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article