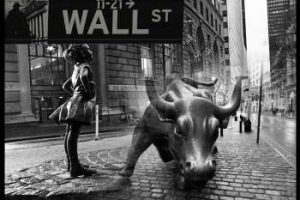

Futures Point To Broadly Lower Open For Wall Street

The U.S. Dollar is strengthening, and the price of gold is on a climb, in response to the inflation situation. This will have an impact on consumer prices also.

Asian shares finished lower, and the European shares are trading mostly higher.

Early signs from the U.S. Futures Index suggest that Wall Street might open mostly lower.

As of 7.00 am ET, the Dow futures were up 20.00 points, the S&P 500 futures were sliding 0.25 points and the Nasdaq 100 futures were progressing 23.75 points.

The U.S. major averages all moved to the upside on Tuesday.

The Nasdaq advanced 120.01 points or 0.8 percent to 15,973.86, just shy of the record closing high set last Monday. The S&P 500 also ended the day just below its record closing high, up 181.0 points or 0.4 percent to 4,700.90.

On the economic front, the Commerce; Housing & Urban Development Department’s Housing Starts and Permits for October will be issued at 8.30 am ET. The consensus for Starts is 1.587 million, while it was up 1.555 million in the previous month. The permits are expected to be up 1.630 million, while it was up 1.589 million a year ago.

The Energy Information Administration or EIA’s Petroleum Status Report for the week will be released at 10.30 am ET. In the prior week, the Crude Oil Inventories were up 1.0 million barrels.

Twenty-year Treasury Bond auctions will be held at 1.00 pm ET.

New York Federal Reserve Bank President John Williams to give virtual keynote before the 2021 U.S. Treasury Market Conference co-organized by the Federal Reserve System at 9.10 am ET.

Cleveland Federal Reserve Bank President Loretta Mester to give opening remarks before virtual 2021 Financial Stability Conference at 11.20 am ET.

Federal Reserve Board Governor Christopher Waller to give Thoughts on Stablecoins before virtual 2021 Financial Stability Conference at 12.40 pm ET.

San Francisco Federal Reserve Bank President Mary Daly to participate in fireside chat virtually before the 2021 U.S. Treasury Market Conference co-organized by the Federal Reserve System at 12.40 pm ET.

Cleveland Federal Reserve Bank President Loretta Mester to give introductory remarks before virtual 2021 Financial Stability Conference at 12.40 pm ET.

Chicago Federal Reserve Bank President Charles Evans to speak about current economic conditions and monetary policy in a moderated Q&A with the Mid-Size Bank Coalition of America at 4.05 pm ET.

Atlanta Federal Reserve Bank President Raphael Bostic to give closing remarks virtually before the Federal Reserve Community Development Research Seminar Series event at 4.10 pm ET.

Asian markets fell on Wednesday. China’s Shanghai Composite index rose 15.58 points, or 0.44 percent, to 3,537.37.

Hong Kong’s Hang Seng index ended down 63.70 points, or 0.25 percent, at 25,650.08.

Japanese shares ended lower. The Nikkei average slid 119.79 points, or 0.40 percent, to close at 29,688.33, while the broader Topix index closed 0.61 percent lower at 2,038.34.

Australian markets fell on the day. The benchmark S&P/ASX 200 dropped 50.50 points, or 0.68 percent, to 7,369.90 while the broader All Ordinaries index ended down 43.10 points, or 0.56 percent, at 7,704.

European shares are trading mostly higher. Among the major indexes in the region, the CAC 40 Index of France is progressing 2.22 points or 0.03 percent. The German DAX is adding 14.77 points or 0.09 percent, the U.K. FTSE 100 Index is sliding 20.30 points or 0.28 percent.

The Swiss Market Index is adding 29.23 points or 0.23 percent.

The Euro Stoxx 50 Index, which is a compilation of 50 blue chip stocks across the euro area, is down 0.54 percent.

Source: Read Full Article