India’s Chip Dreams Won’t Happen Unless…

OSAT majors have concerns about India’s ability to provide a stable, predictable, and lasting policy environment for years to come, which is key for making a decision in a capital-intensive business.

India is facing tough competition from Penang in Malaysia, the Philippines, and Vietnam, as global outsourced semiconductor assembly and test (OSAT) firms based mostly in Taiwan are looking for locations in Asian countries to hedge their geopolitical bets.

The OSAT majors have concerns on India’s ability to provide a stable, predictable, and lasting policy environment for years to come, which is key for making a decision in a capital-intensive business.

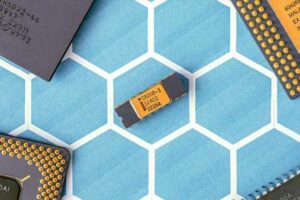

OSAT companies provide assembly and testing services to multiple players.

Global auto majors and other clients pushed their global OSAT partners to look at alternative locations to mitigate the risk of geopolitical tensions between the US and China, and between China and Taiwan.

Their suggestion is for a China + and Taiwanese + strategy that entails building capacity in other Asian countries and the US to ensure that there is minimal supply chain disruption of the kind they faced earlier.

The global OSAT majors headquartered in Taiwan include ASE Technology Holding (one of the largest players in the world), Powertech, KYEC, ChipMOS, and Chipbond, among others.

India could be an attractive destination because it is offering OSAT companies an upfront 50 per cent subsidy in the cost of putting up a plant under the government’s semiconductor scheme. This is comparable with other global incentive schemes.

However, global OSAT majors want their policy concerns addressed.

Semiconductor fab companies say they have all raised concerns about the need for stability and predictability in Indian policies over a long period of time as these plants are very capital intensive.

A senior executive of a leading chip company that had held discussions with leading OSAT players on shifiting to India said, “While there is awareness of opportunities in India, there are concerns on the ecosystem and ease of doing business in India which need to be addressed…The engagement between the OSAT companies to understand the incentives and the big picture has not been high,” the person added.

They say that while the Indian Semiconductor Mission, which scrutinises applicants, has been proactive, the finance ministry and the revenue department need to be aligned with global standard practices to attract investment.

They also point out that India’s tax policy does not seem to be aligned with the requirements of OSAT companies such as tax regimes for toll versus contract manufacturing.

In toll manufacturing, the source company that gets the order made is responsible for the supply of raw materials to the manufacturing company, while this is not the case in contract manufacturing.

What has been suggested is a task force in India to engage with Taiwanese companies along with meetings with the revenue department for a deeper understanding of the tax regime.

Malaysia, and especially Penang, enjoys a major advantage over India as they had developed a semiconductor ecosystem decades ago.

Many companies, from chip players to OSAT companies, are already established there and the ecosystem caters to the needs of giants such as AMD, Analog Devices, Micron, Intel, Jabil, and Agilent Technologies.

The good news for India is that US-based chip maker Micron Technology is in the final stages of gaining clearance to set up an assembly, testing, marking, and packaging plant in India that will be mostly for its own captive needs.

Source: Read Full Article