Bitcoin Price About to Smash $30,000, Leaves Blue Chips in Dust

Bitcoin price on Friday touched another all-time high at $29,700, after the world’s most popular digital currency surged nearly half in just two weeks and almost quadrupled in value this year.

Continuing its upward rally amid heightened interest from bigger investors, traders are now eyeing the psychological $30,000 per bitcoin level sooner than later.

As a result, the latest gains took the combined value of all the bitcoin tokens in circulation past $543 billion for the first time, according to industry website CoinMarketCap.

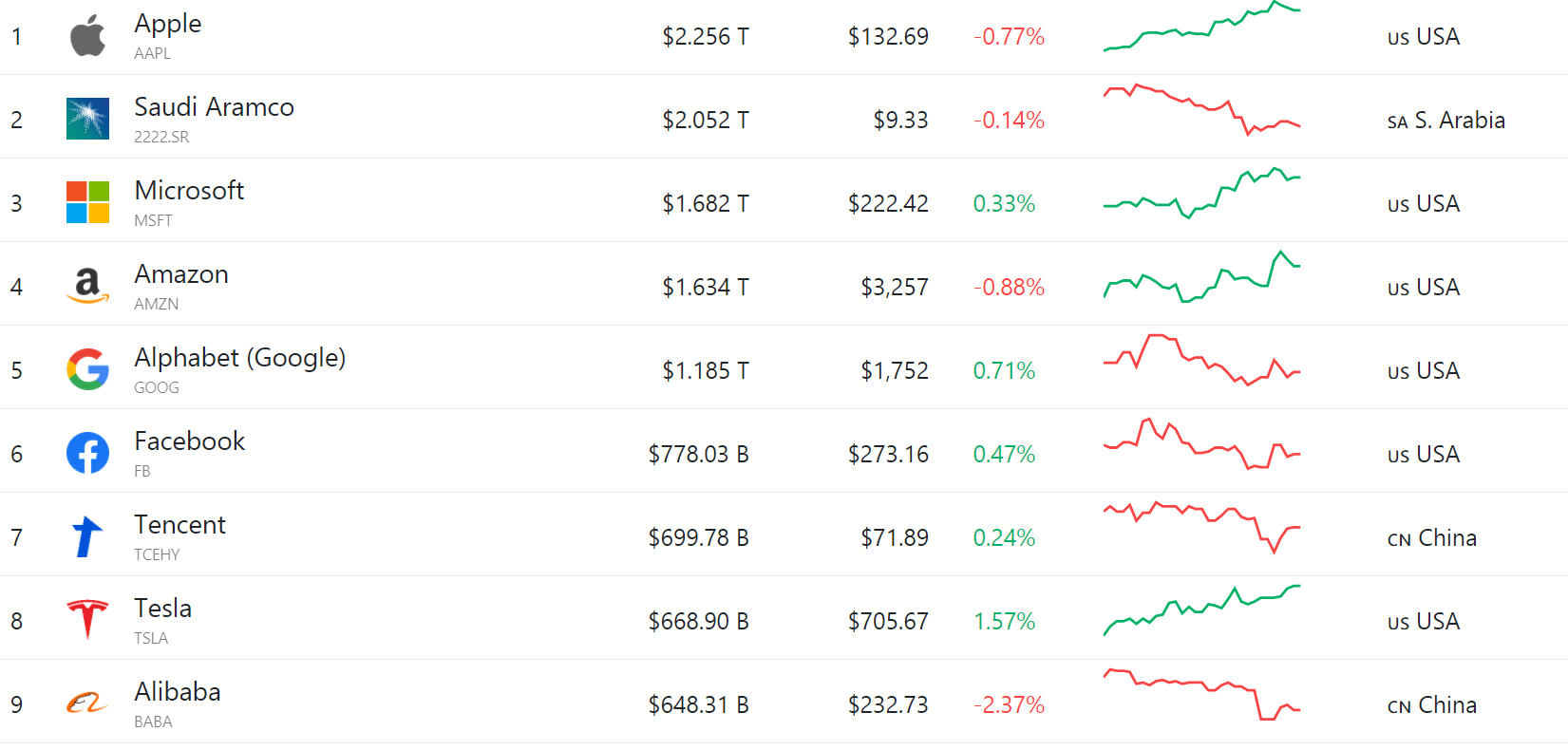

Bitcoin’s market capitalization is now more than the $482 billion cap of Visa, the world’s biggest financial service company. Not only Visa, but Bitcoin is also valued more than biggest publicly traded companies like Berkshire Warren Buffett’s Hathaway ($542 billion), Samsung ($481 billion) and Walmart ($407 billion).

At this price point, the No.1 cryptocurrency has claimed the 9th highest market cap of all assets, trailing behind Alibaba and Tesla.

Bitcoin is going head-to-head against Berkshire Hathaway, led by legendary investor Warren Buffett who has previously dismissed Bitcoin as “rat poison squared” and has said cryptocurrencies “will come to a bad ending.”

Bitcoin has seen an unprecedented rise this year, but no single event seems to be the main reason for the rising streak that have pushed its price to bust out new records almost every day.

Overall, Bitcoin has seen demand from retail investors after giving better returns than other traditional investment assets, as well as growing speculation it would become a mainstream payments method. Deep-pocket investors were also attracted by its perceived inflation-hedging and safe-haven qualities and potential for quick gains amid some positive developments around the cryptocurrency.

Other factors that have supported its recent record gains include PayPal officially making its move into the cryptocurrency market. Further, a number of large institutional investors showed interest in investing into products tied to the cryptocurrency.

Other major cryptocurrencies, which tend to move in tandem with bitcoin, were flat. Ethereum, the second biggest, was up 0.5%, having recorded a 2020 gain of around 450%

Source: Read Full Article