Blockfi Says FTX Is One of the Major Driver of Higher Recoveries, Eyes $1 Billion in Recovery – Coinpedia Fintech News

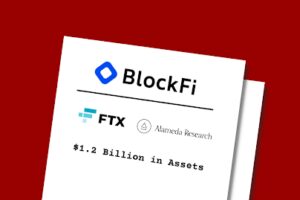

According to recent court filings, troubled cryptocurrency exchange FTX might act as one of the major drivers behind the potential recovery of over $1 billion dollars in assets for creditors and clients of bankrupt crypto lender BlockFi. The success or failure of litigation supporting the claims against FTX and other commercial counterparties will significantly impact the recovery amount.

BlockFi has listed various projected recoveries, including the liquidation of assets and claims from different entities. However, the actual recoveries may differ from these projections based on several factors.

“While recoveries will be based on a number of factors, the largest driver of higher recoveries are our claims against Alameda and FTX,” the firm said on Friday.

As part of the plan, there is a list of expected recoveries by BlockFi and these projections include the liquidation of approximately $1.06 billion in BlockFi Inc. Interest Account Claims, $216 million in BlockFi Lending LLC Private Client Account Claims, and $371 million in BlockFi International Ltd. However, it is important to note that the actual recoveries received by clients may significantly differ from these projected figures.

BlockFi currently holds approximately $355 million worth of crypto assets that are frozen on the FTX exchange. Additionally, they have provided a loan of $671 million to Alameda Research, the trading arm of FTX. Both FTX and Alameda Research are undergoing Chapter 11 wind-down proceedings in Delaware.

In a recent development, U.S. Bankruptcy Judge Michael Kaplan ruled that BlockFi’s custodial wallet users are eligible to receive nearly $300 million in owed funds. This ruling allows for the return of non-estate digital assets held in client wallet accounts, subject to applicable set-offs. The liquidation plan, which outlines the return of these funds, was filed on Friday.

Source: Read Full Article