Trade Processor’s Case as Your Liquidity Bridge Solution

Like any other businesses today, brokerages are constantly looking for new ways of enhancing and upgrading their risk management strategies. But what if the solution was right in front of them the whole time?

The base of any brokerage company, a liquidity bridge solution, typically offers a wide range of tools to help mitigate the risks or avoid them altogether.

Today we will share how the bridge can strengthen the broker’s position against risks using the example of Trade Processor by Tools for Brokers.

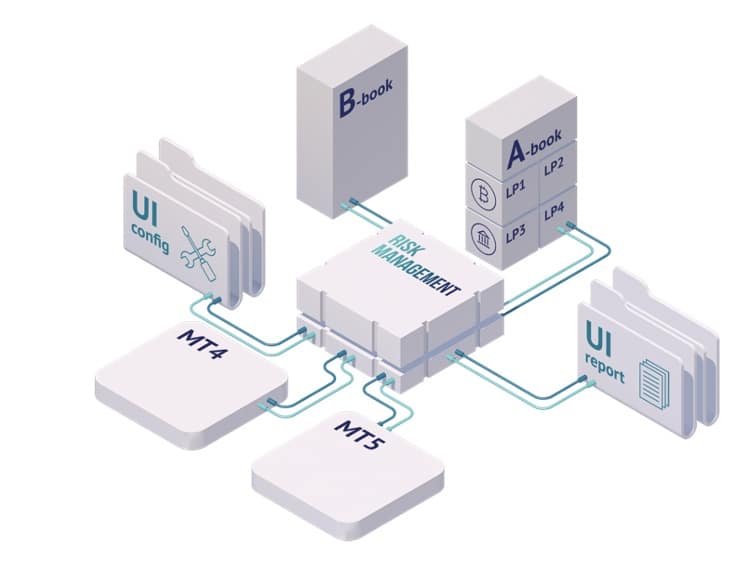

The solution’s architecture

While there are pros and cons to the architecture of any type of solutions, the way the software is built can define how you will be protected against certain risks.

Trade Processor offers decentralised and distributed architecture. Decentralised architecture means that orders are executed quickly, as there are no extra steps to send data back and forth which might cause a change in the final pricing.

The distributed architecture ensures a more secure installation with less chance of going offline or overloading the system. It also means that the software product is scalable and will grow with your company.

Flexible order execution

Order execution is the centrepiece of the bridge. A thought-through and flexible execution system can target several brokerage-associated risks:

- Aggregation methods available with the solution directly affect the end price of the order and, subsequently, brokers’ turnover and customer satisfaction. One of the main targets for brokers is providing the best pricing for their clients. The term ‘best price’ is subjective and can mean different things to different clients. Having multiple aggregation options makes brokers more flexible and helps them get as close to the ‘best pricing’ as possible.

- Liquidity Providers (LPs) that the bridge is partnering with play an essential role in the broker’s success. While the number of signed LPs is not overly critical, it is a general rule that having a list of companies to choose from reduces the risk of orders being executed at a worse price.

- Continuous Execution of large orders is another functionality that allows brokers and clients to get the best pricing. Continuous Execution means that a big order is split into several smaller ones, and it is executed over a period of time. In that case, the broker is not wiping out the market depth completely but instead picks more favourable pricing over time, resulting in better overall pricing for the order.

- Out-of-control exposure and swap costs can become a significant risk if they are left unattended. The reason it gets out of control is usually that the processes are not automated. The Volume Consolidation feature in the bridge takes over these tasks and automatically consolidates all open positions across all LPs at the end of each day. By using it, brokers avoid errors associated with manual work and save many hours of their time.

Integration with third-party solutions

A good solution will not prevent you from integrating with a third-party software or platform. While your technology provider may strive to give brokers every tool that they need, they mustn’t get in the way if the broker decides to integrate another tool.

It represents the risk of missing out on the latest technology and creative solutions, so ideally, a bridge should include an API to enable brokers to partner with any product they choose.

Built-in reporting for compliance

Reporting requirements for each broker depend on where they are based, which markets they operate in, and what services they offer. Yet, every brokerage needs reporting, whether it is more for internal analysis and statistics or compliance with regulators.

Not complying with regulatory requirements and failing to provide all necessary information is a critical risk for brokers.

Not having an established reporting system in place is a financial risk, as brokers may look for last-minute solutions which can be overpriced.

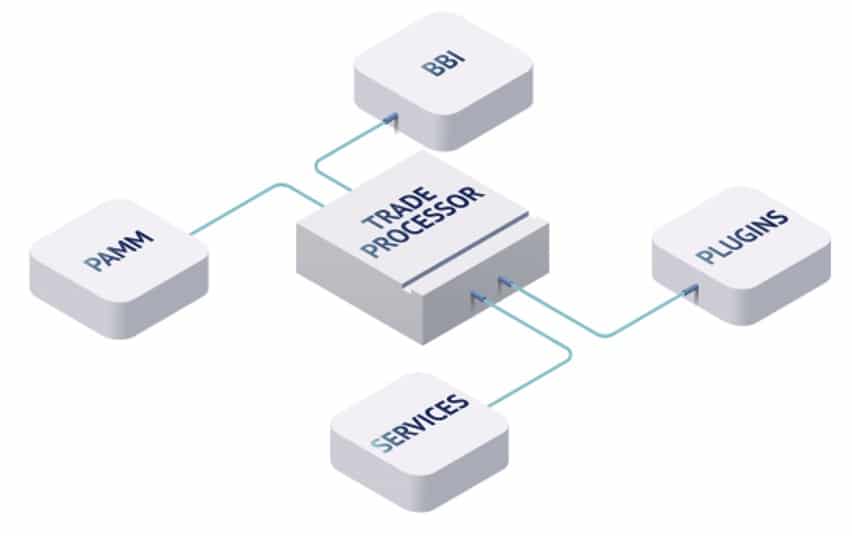

Ecosystem of solutions to complement the functionality of the bridge (PAMM, BBI, plugins)

A risk that brokers might face when acquiring software is that it is not fully compatible with the rest of the infrastructure.

Or it might be compatible, but some of the required functionality is missing and takes time to develop.

One way to avoid this is to run a thorough test and do the research before placing an order.

Another way is to look for technology providers that acknowledge the potential risk and work on providing brokers with comprehensive solutions that exceed their primary needs or requests.

TFB has developed an ecosystem of solutions that cover more than bridging requirements.

There is an advanced data monitoring, reporting and management solution BBI, flexible and powerful PAMM money management, a separate offer for White Label brokers, and multiple plugins that cover more specific needs.

Not all problems can be solved with technology, but it is a good starting point. The right tools help avoid and mitigate strategic, financial, compliance, reputational, and operational risks.

Suppose brokers are unsure how they can optimise their workflow to reduce the threats. In that case, we recommend speaking with a trusted advisor, whether it is a technology partner or an industry peer.

There is always the potential for improvement in business, and we find that successful brokers often tend to be proactive and more open-minded in terms of new practices and methodologies.

Source: Read Full Article