XRP Sees Burgeoning Acceptance From Institutional Investors

XRP is one of the most interesting cryptocurrencies in this space. Unlike digital assets like bitcoin and ether, XRP’s prominence is geared towards its use for cross-border transactions. Sending money across borders is notably an expensive and often slow process but XRP and Ripple seem to be taking this head-on.

These efforts appear to be paying off as according to a recent report from digital currency manager CoinShares, XRP has become the most attractive asset among institutional investors. In the last week, institutional investment in XRP skyrocketed.

XRP to the (Institutional) Moon

The report states that roughly $33 million of institutional funding was allocated to XRP investment products last week. With this, the assets under management connected to XRP are now at $83 million. A number of factors were credited for this including concerns about inflation.

“We believe this recent renewed appetite for digital assets is due to a combination of increasing acceptance from institutional investors, fears for inflation, and price momentum,” the report related.

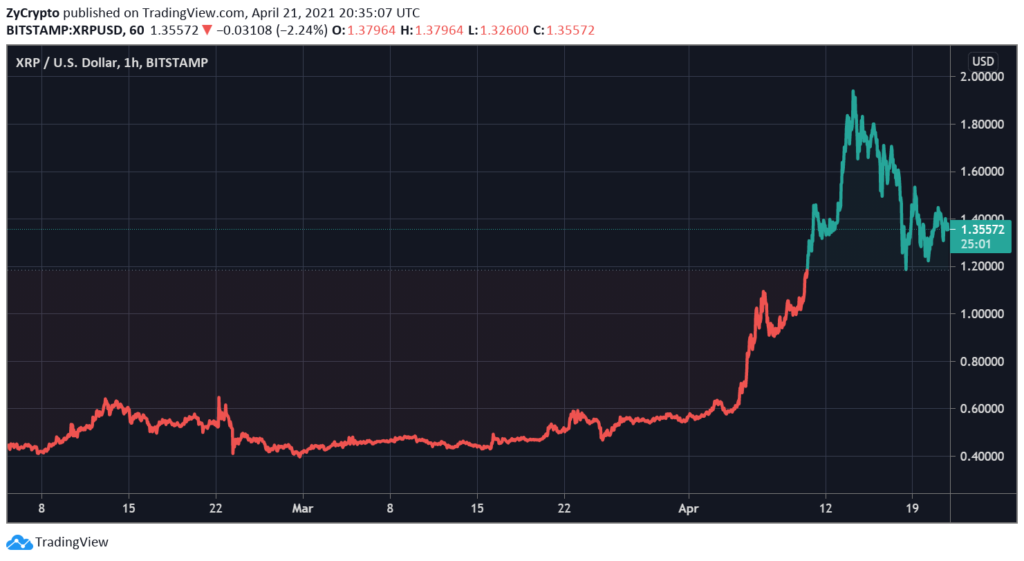

The price of XRP has also seen a recent recovery as it blighted earlier this year but now seems to be kicking back up. The initial decline in price is credited to the current legal battle that Ripple Labs is embroiled in with the Securities and Exchange Commission.

Besides the price decline, money transfer giant MoneyGram also pulled the plug on its partnership with Ripple. By March 9, 2021, the price of XRP was $0.47, which is significant because that is higher than its worth before the lawsuit. Now, the price has more than tripled to trade above $1.3.

It should also be noted that there is currently more institutional support for cryptocurrency as a whole and thus, more firms are confident in putting their resources behind an asset like XRP.

On the legal side, Ripple is currently trying to stop action being taken by the SEC to acquire information about its overseas business dealings. According to Ripple’s lawyers, the actions taken by the Securities and Exchange Commission to acquire this information from Ripple’s foreign partners amount to intimidation.

While the end result of this legal battle with the SEC is far from concluded, it is clear that the firm is succeeding in other areas.

Source: Read Full Article