Nearly Half a Million ETH Burned

Ethereum has burned close to half a million of its supply in just two months with the burning seemingly currently running at 250,000 eth a month, worth $900 million.

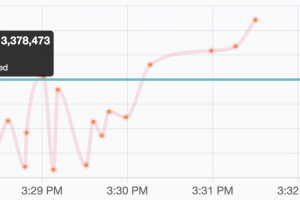

Some 477,000 eth has been burned at the time of writing, worth $1.7 billion, with it currently running at $1.3 million or 372 eth burned per hour.

Ethereum’s current total supply is at 117,842,811, making it 0.5% burned. At this rate, about 3% of the total supply would be burned a year.

Currently miners get about 4% in new supply. Ethereum’s inflation rate thus has been slashed by 75% to 1% of total supply a year.

That’s less than bitcoin which is running at 1.76%, with the eth burning making it about half of that in a reversal of sorts as bitcoin’s inflation so far has usually been half of eth’s.

What’s more, the merger is coming. Devs are finalizing internal testing, with a public testnet to be expected maybe sometime this winter.

Once the merge goes out – perhaps during spring – and if this rate of burning keeps up, then ethereum will become deflationary with its total supply reducing by 2% a year.

Currently this is courtesy of mainly NFTs, which are the biggest contributors to the burning as a category.

There’s new ones somewhat constantly with Ethereals being the latest. They sold out within 20 minutes apparently.

Plenty of money to be made in them NFTs, and at some point you’d think plenty to be burned as the second NFT ‘bubble’ eventually cools down.

The first one was in 2017 when CryptoKitties invented them. That there’s a second one maybe suggests these aren’t quite a fad categorically speaking.

Where specific projects are concerned however, you’d expect the likes of Shiba Inu to perhaps not quite return.

The 2017 equivalent is maybe tron, but they at least had a copied whitepaper. On the other hand, Shiba Inu has at least burned 356 eth and just for today.

So eth holders in general now benefit from both dumb and smart, making eth a safer asset than specific projects in it.

That’s a very new thing, and since we haven’t seen it before in a top asset, it’s hard to say what it means exactly, but eth is seemingly becoming a ‘real’ thing with ‘revenue’ and ‘dividends’ and an ‘economy’ that is perhaps beginning to make it a different sort of asset than other cryptos in a way that suggests we’ve actually created something of fairly concrete value beyond the digital gold like qualities.

Source: Read Full Article