Bitcoin Must Hold Above Crucial Support to Stay Bullish

Key Takeaways

- Bitcoin appears to have entered a highly volatile period.

- As long as the $51,000-$50,500 support level holds, the market outlook for the cryptocurrency remains bullish.

- Further buying pressure could push BTC to $57,200.

Bitcoin has breached a critical resistance barrier that could see its price rise by nearly 13% despite recent price fluctuations.

Bitcoin Remains Bullish Despite Volatility

Bitcoin prices rose above $52,000, but the upswing was short-lived as it shed 1,000 points within minutes.

Data from Bybt shows that nearly $20 million worth of long Bitcoin positions were liquidated across the board over a five-hour period. The losses were a result of Bitcoin’s erratic price action.

Bitcoin prices fell by 2.30% after trading at a high of $52,220. As Bitcoin dropped toward the $51,000 support level, it created a cascade of liquidations. Still, it seems that prices are well-positioned to advance further as long as this support level holds.

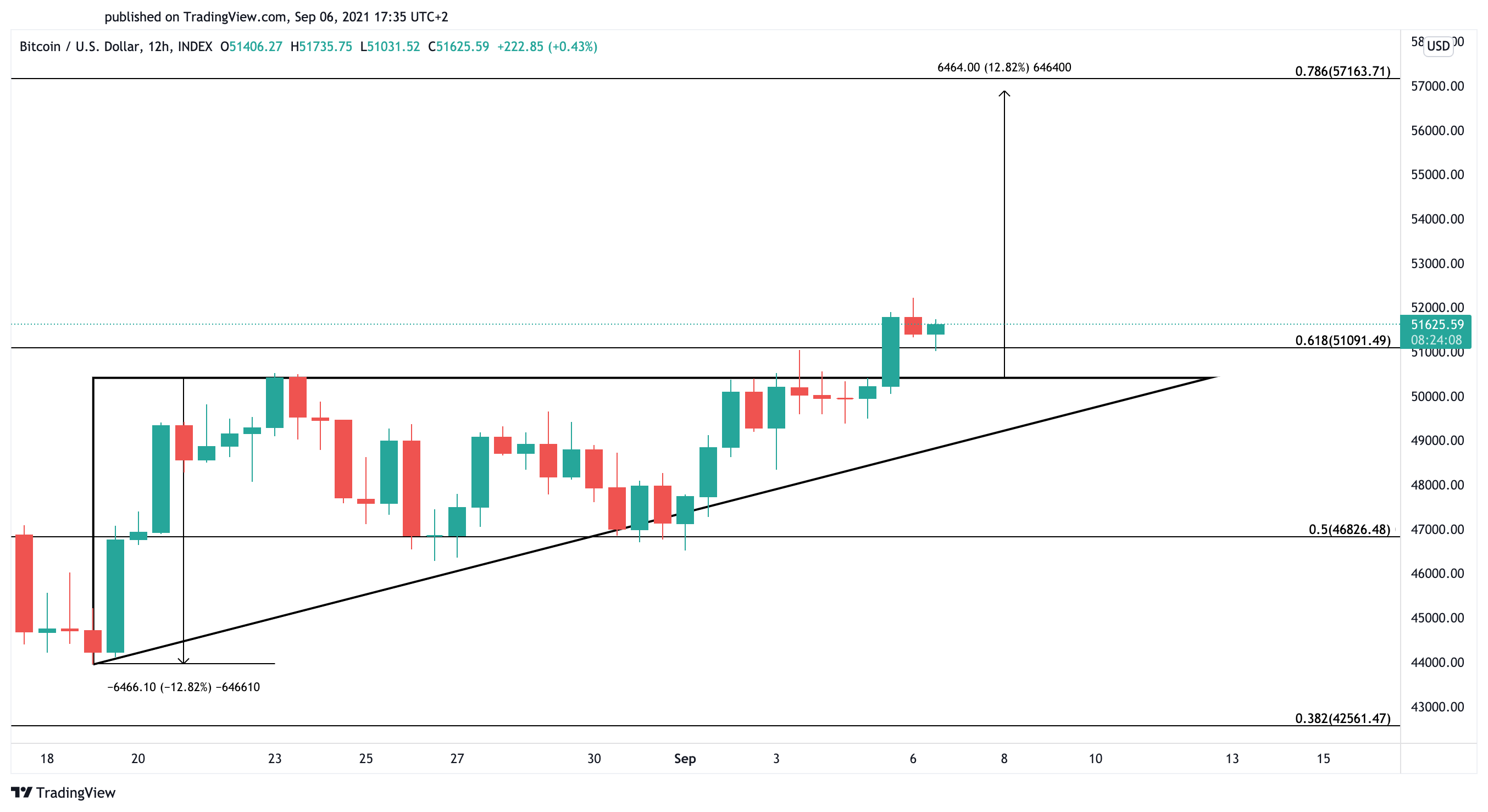

The 12-hour chart reveals that Bitcoin broke out of an ascending triangle on Sept. 5 after enduring a 17-day-long consolidation period. The height of the technical pattern’s y-axis added to the breakout point forecasts a nearly 13% run-up toward $57,200.

Bitcoin Must Remain Above $50,500

For the bullish thesis to be validated, BTC needs to remain trading above the $50,500-$51,000 price range. Failing to hold above this crucial demand barrier could lead to significant losses.

The Fibonacci retracement indicator, measured from Bitcoin’s all-time high of nearly $65,000 in April to its low of $28,750 in June, provides a sign of where prices may be headed next.

A breach of the underlying support might lead to a correction toward $46,830, while a spike in selling pressure around this price level would likely develop into a more pessimistic outlook as the next important support area sits at $42,500.

Disclaimer: At the time of writing this author held Bitcoin and Ethereum.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article