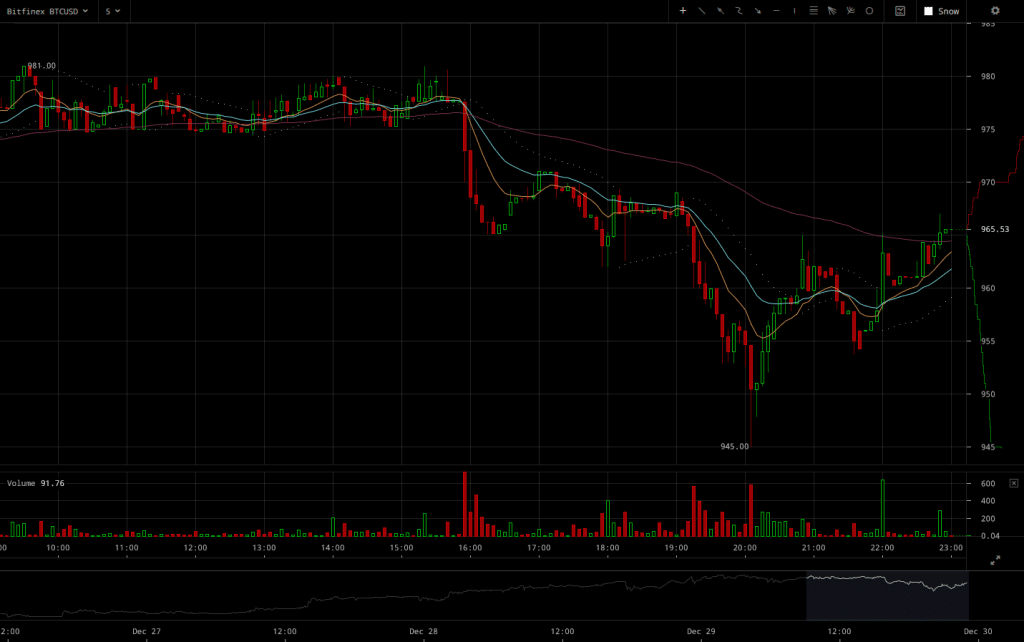

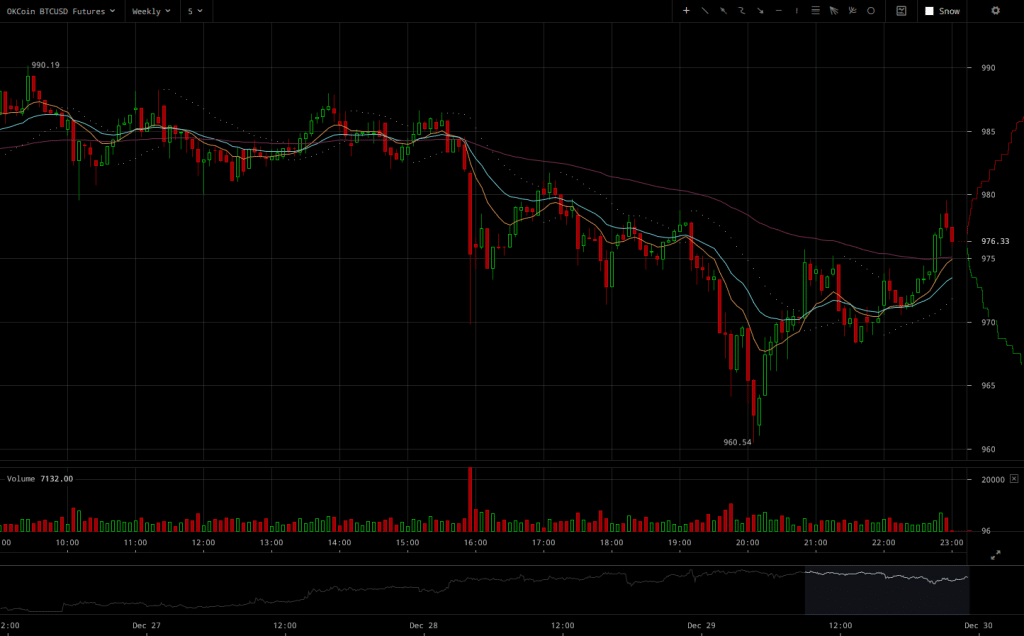

Bitcoin Price Down Through Post Peak Volatility

Bitcoin markets sure are hyperactive today, with trading volumes being close to historic highs. Yet somehow, selling pressure seems to once again be gaining ground. Bitcoin prices touched the bottom of $945 today and BTC/USD markets seems to be heavily affected by the volatility following the peak above $980.

Major Signals

- Bitcoin’s price sure seems to have stopped rising but trading volumes are at remarkably high levels still.

- Selling pressure pressuring the price down seems surprisingly sudden but comes through a prolonged price rally, after which volatility is expected.

- Major downward spikes caused by large sell orders aren’t really followed by swift recoveries so it’d safe to say that traders might be assuming a shift in the market’s sentiment.

Either way, bitcoin traders only seem to be following up with a hasty recovery after a downward spike when BTC/USD reached the bottom of $945 in the last few hours. The size of previous sell orders that caused downward spikes might have scared traders off betting in a recovery, and hence further falls followed.

Overall, the market’s sentiment seems to be affected by the events while going through a bearish trading session that feels like a post-rally correction. Yet, the fact that the drop was mostly caused by only a few large sell orders means that traders are still looking to pick up signals on what direction could be followed afterwards. It’d safe to say that the following hours are going to be crucial for BTC/USD markets.

Source: Read Full Article