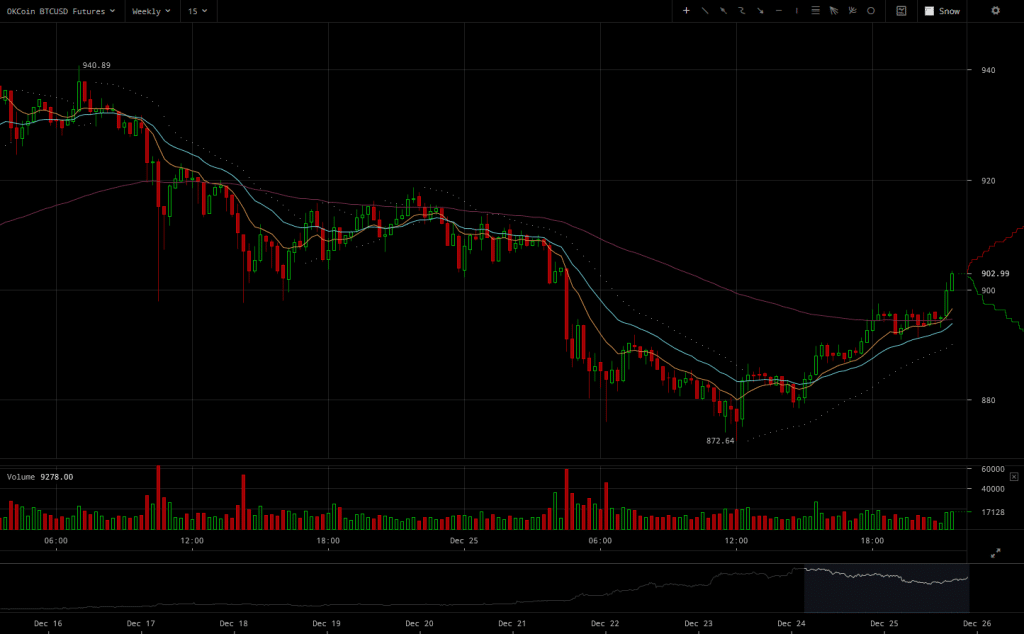

Bitcoin Price Falls Bellow $900 Levels as Profit Taking Begins

Bitcoin markets appear to be in decline ever since the peak of $920 was reached on December 24. While trading volumes also keep going down, they’re still highly above average. However, selling pressure has kept pushing the price down further ever since the preceding trading session.

Major Signals

- Trading volumes didn’t go down enough to not stay above average, yet selling pressure seems to have taking over the leadership of the market.

- The post rally bottom price that was recently reached was slightly below $860, but a not so enthusiastic recovery since pushed the price above this level.

- Large sell orders and back to back selling pressure kept pushing the price down yet the market didn’t take a downturn as several buy orders helped the price recover to $880 levels.

More and more traders seemed to be losing confidence in what direction BTC/USD markets could follow and the recent recovery didn’t manage to bring the price back above $900 levels. The market’s sentiment is surely moving away from the more bullish attitudes of past trading sessions.

Summarizing,it’s important to highlight that it’s not all gloom and doom with bitcoin markets yet. The significant breakthroughs resistance levels over the last few days are not to be neglected. The market is still trying to adapt to the newly achieved levels and even with the current market sentiment it wouldn’t be impossible to see the price rallying once again after selling pressure has settled.

Source: Read Full Article