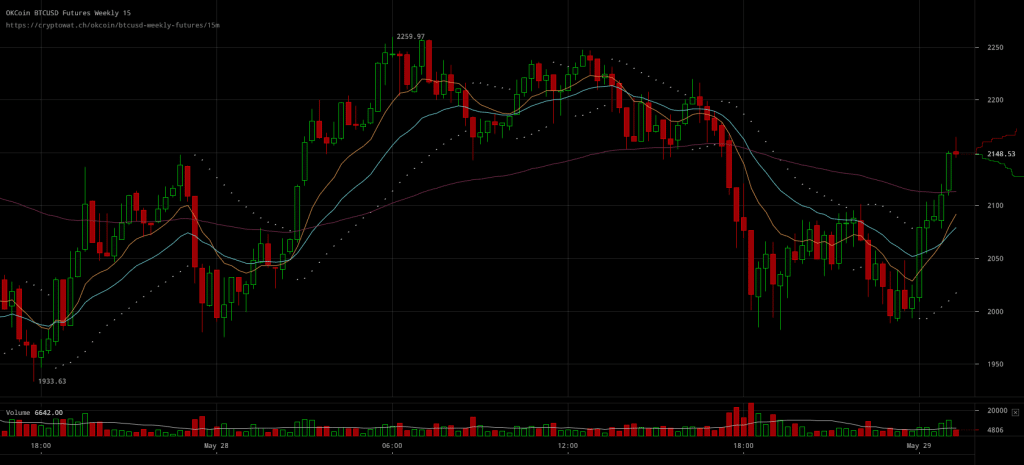

Bitcoin Price Keeps Looming $2200 Levels Amid Volatility

Bitcoin prices are on a volatile path with no certain direction. What’s for sure is that markets showcase at least some intent to support $2200 levels, yet in so far this levels has been breached several times, even following the previous recovery. BTC/USD rates go through numerous ups and downs through trading sessions while trading volumes decline but indecisiveness remains.

Major Signals

- Bitcoin traders appear to be quite indecisive about what course prices would follow through the up and coming trading sessions.

- BTC/USD rates don’t seem to be stabilizing at a certain level, yet the observed volatility has put prices back above $2200 levels in the recent hours.

- In spite of resistance and selling pressure, prices did peak above $2300, close to levels of the previous recovery’s peak.

What’s worth pointing out is that bitcoin markets aren’t all gloom and doom after the sell off that halted the rally. Traders are still fighting for a recovery, and while markets might not be ready to welcome positivity right now it wouldn’t be unlikely to see the market sentiment improve as selling pressure cools down.

Source: Read Full Article