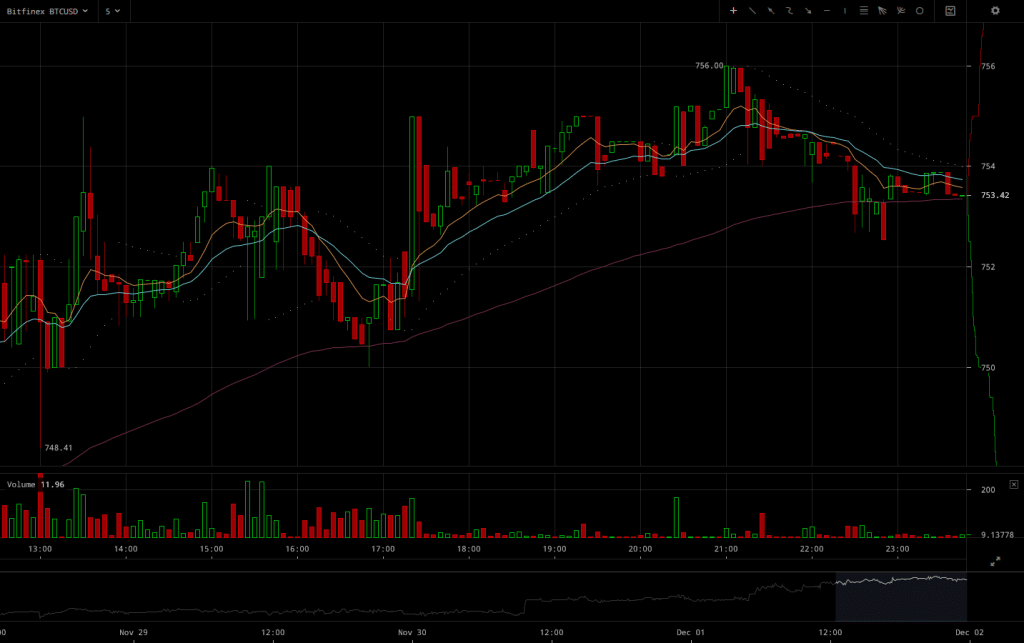

Bitcoin price keeps trading above $750 after spike

Yesterday’s bull run not only broke resistance, but also ushered the price to levels above $750. The market seems to have embraced the price rise, as we’ve yet to see a drop below that level.

Major Signals

- Market sentiment has changed dramatically since the time before the price rise leading to levels above $750.

- Support seems to have formed at $750, yet resistance at $760 outweighs it.

- After breaking resistance, apparent volatility has yet to be observed. Some traders seem cautious, perhaps in fears of the effect profit taking could have on the market.

Bitfinex BTC/USD has been having some ups and downs after the rise but support levels at $750 were not broken in spite of some selling pressure pushing the price down and close to that level. Resistance seems to still be taking its form and volumes are again higher than the ones of the previous day; so it’d be safe to say that even what current resistance has achieved is impressive.

Furthermore, another notable thing about the recent price rise is how off guard other markets were caught by BTC/USD traders. Yet, the reception it had was remarkably welcoming. It feels like the recent price rise is the exodus the market was seeking to turn away from the bearish market sentiment.

However, futures traders seem to still be a bit critical of the recent price rise. As one can see in the above OKCoin BTC/USD weekly futures chart, futures traders were initially indecisive when it came to “adjusting” their market in accordance to live BTC/USD rates, although the two markets eventually aligned their movements.

Still, there was a correction at the futures market and sideways trading ensued. Futures markets might have support that outweighs resistance, but the market still seems to be in fear of the results (the still unrepresented) selling pressure could bring to the market.

Finally, we can finally once again say that the outlook for BTC/USD is good. A further price rise would probably be met with quite a bit of resistance, especially amidst such trading volumes. But the outcome of the recent price spike has surely been satisfactory and there’s enough support to mandate that a huge price drop at this point seems unlikely.

Source: Read Full Article