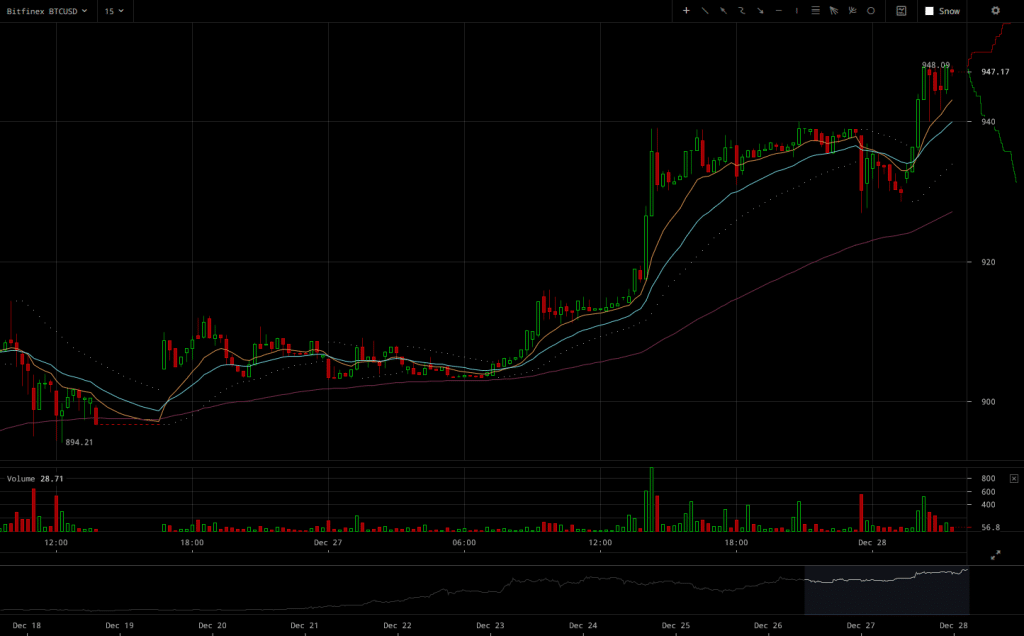

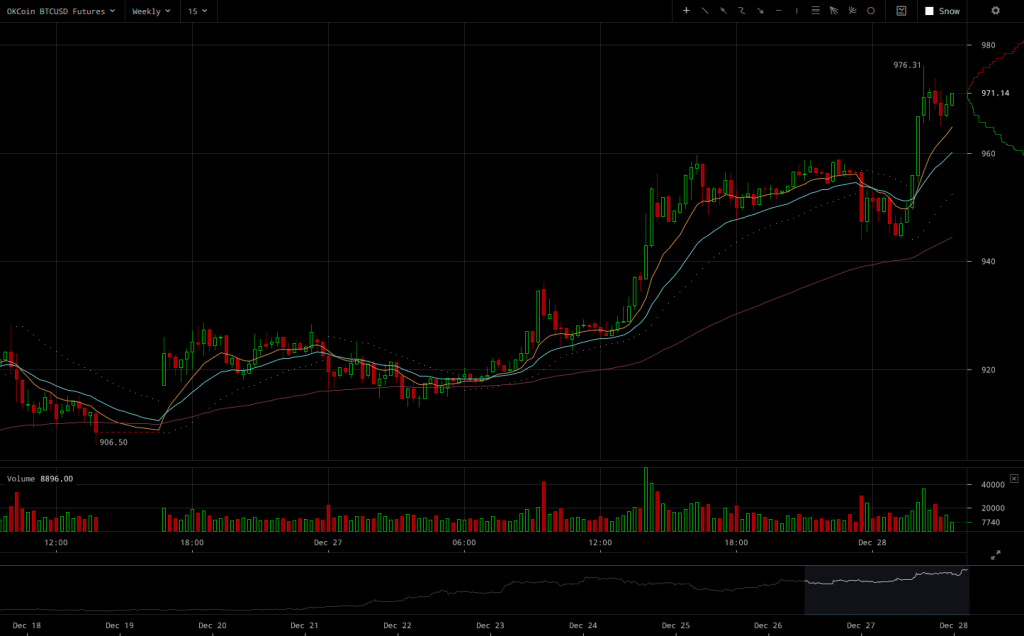

Bitcoin Price Rallies Once Again as BTC/USD Flirts With $950

Bitcoin markets are back to rallying once again. With substantially large buy orders being the leading force in the preceding trading session, BTC/USD markets are certainly in for another rally.

- Buying pressure in the last few hours has managed to push the price close to $950, smashing any subsequent resistance.

- A few large back to back buy orders seem to be responsible for the ongoing price rise in BTC/USD markets as bulls seem to smashing selling pressure.

- The upward price spikes seem sudden yet the market’s reception indicates a bullish market sentiment as any correction after spikes is met with more buy orders.

With the market’s sentiment being outstandingly bullish, it’s also important to note that new post 2013 highs are reached among historically high trading volumes. Bulls are winning a tough fight, and the fact that today’s trading volumes are higher than yesterday’s already large ones is no joke.

With extra optimism and in increasingly bullish market sentiment, it’d be safe to say that the price rise just keeps gaining momentum and the uptrend is doing remarkably well. While substantial buy walls have formed at $950 levels, bulls make it feel like such a resistance level could be chewed through with ease.

Source: Read Full Article