Bitcoin Price Rebounds After Wave of Selling Pressure

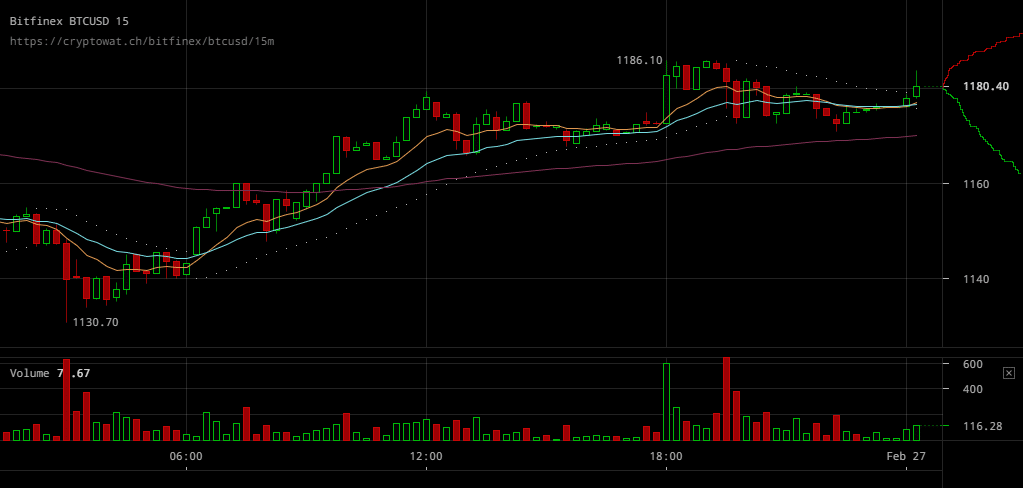

Bitcoin markets are going through a recovery phase following a trading session through which selling pressure continued to push prices down. BTC/USD rates went on to trade above $1080 levels but the price has since settled slightly below $1080. This a recovery following a downfall down to $1030 levels.

Major Signals

- Whilst trading volumes are slightly down since yesterday, buying pressure is greater as it contributes to the recovery

- Whilst the market’s sentiment doesn’t appear to have ushered BTC/USD rates into another rally the recent development is certainly a break from negativity

- Resistance seems to have formed at levels below $1200 so a recovery back to such levels would require even more buying pressure

Finally, it’s important to highlight that the whilst prices have gone considerably down from the rally’s peak, it wouldn’t be unlikely to see more bullish developments if the market’s sentiment remains positive. Today’s recovery showcases how markets the mood of traders apparent, highlighting recently established support is not easily shattered even after profit taking.

Source: Read Full Article