Bitcoin, Stocks, and Gold Rise over the Dollar after Inflation Report

Key Takeaways

- Price inflation in March was slightly higher than expected according to latest CPI figures.

- The S&P 500 index and Bitcoin made new all-time highs today.

- Bitcoin, stocks, and gold continued to show strength after the announcement, pointing to inflation concerns in the market.

The market’s bullish sentiments remained unaffected by the U.S. consumer price index (CPI) inflation numbers released by the Labor Department this morning. Gold, Bitcoin, and stocks showed slight upticks, while treasury yields remained flat.

Hot Inflation, Stronger Bitcoin

The month-to-month (MOM) CPI reported rate is 0.1% higher than Dow Jones’ expected value of 0.5%, meaning the average price of consumer products is trading 0.6% higher than last month.

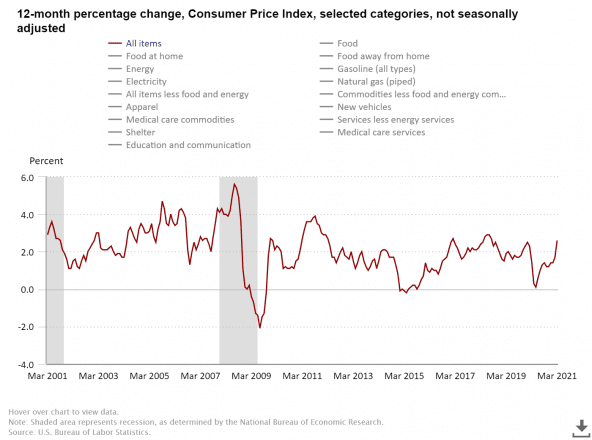

The year-to-year (YOY) value is 2.6%, the highest since August 2018. The figure was slightly above expectations of 2.5% and significantly higher than the 1.7% result seen last month.

The higher YOY value is attributed to the gut-wrenching crash in March last year. The YOY is expected to remain high until June due to the base effect.

The producer price index (PPI) data last week caused a strong rise in the stock market due to its stronger-than-expected value. The index, which measures inventory and production cost for various industries, increased 4.1% YOY, the highest rise in nine years.

The extreme rise is partially due to what’s known as the “base effect,” in which inflation figures appear higher or lower due to unusually low or high figures in the previous period. However, global supply constraints during the pandemic also played a role.

The latest CPI data release confers to investors’ inflation concerns driving the price of stocks, gold, and Bitcoin.

Bottom Line

The market situation has been consistent since last month.

The Fed is not worried about the short-term effects of inflation. However, many economists argue that the recent stimulus will hurt the value of the USD as inflation runs hotter than the nation’s economic recovery rate.

The U.S. dollar index (DXY), which measures USD’s performance compared to a basket of global currencies, dropped 0.34% from today’s high after the announcement, trading below $92.

The announcement had no major impact on U.S. treasury bond yields.

In the beginning, S&P 500 dropped in tandem with DXY at the 9 am opening bell. The index made a quick recovery to $4130, close to the new all-time high of $4131, attained earlier today.

Gold’s value rose by $6 per ounce with a 0.35% rise on an hourly scale, trading at $1735 per ounce after the announcement.

Bitcoin’s bullish run from Monday continued unabated this morning as the leading cryptocurrency traded above $63,000, a new all-time high.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article