Crypto Briefing's CB10 Index Yearly Returns Top Ethereum

Key Takeaways

- Crypto Briefings’ CB10 portfolio reconstitution for March resulted in increased allocation in Bitcoin and Cardano’s ADA.

- The increasing concerns about Ethereum’s rising fees seems to have created a strong tailwind for competition.

- Dogecoin entered the CB10 index replacing AAVE.

Crypto Briefing’s CB10 experimental index was able to cushion the recent downtrend in ETH. This protection was thanks to diversification and disciplined investment in the top ten cryptocurrencies weighted by market capitalization on CoinGecko for U.S. investors.

Crypto Briefing CB10 Index Performance

The CB10 crypto index returned 44.4% in February.

A hypothetical $1,000 invested on Jan. 5 grew to $1,080 (yielding 8%) by month’S end and has risen by another $491 in February.

The cumulative return in CB10 since formation at the beginning of the year is 57.7%. In comparison, BTC has risen by 59.5% and ETH 27.5% year-to-date. The index’s performance closely tracked the alpha cryptocurrency’s price action.

The rising gas fees on Ethereum showed cracks in ETH price as the market’s liquidity flew to alternative projects. Numerous DeFi projects in 1inch, Compound, The Graph, and others expanded their reach beyond Ethereum.

Ethereum’s competition in Binance Smart Chain and Cardano grabbed the market’s main attention as BNB and ADA gained 360% and 175% since Feb. 1.

In February, across crypto markets, another notable trend was the shift back to native Layer 1 tokens compared to DeFi governance tokens.

Rebalancing CB10 for March

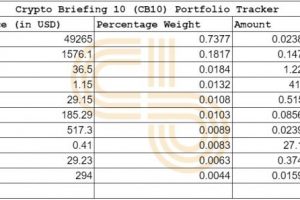

The reconstitution of the CB10 portfolio was successful at 10: 20 am EST on Mar. 4. The updated distribution of hypothetical $1,000 can be found here.

Ethereum was the biggest loser in this month’s rebalancing at negative 3.43%, thanks to the rising popularity of Ethereum’s competition. BTC and ADA were this month’s biggest winners with a 0.96% and 1.67% increase in allocation.

While BNB’s extraordinary rise has brought mainstream DeFi discussion around it, still, it did not make it to Crypto Briefing’s index as the portfolio is U.S. based, and neither Kraken, Gemini, nor Coinbase Pro lists BNB.

Instead, Dogecoin entered the index during the reconstitution with 0.52% allocation, replacing AAVE at 0.44%. DOGE was eliminated last month due to extreme volatility in the token. However, DOGE holders have shown tremendous resilience in the last couple of weeks.

DOGE replaced AAVE; currently, the only DeFi governance token in the top ten crypto index is UNI.

The methodology for the rebalance was shared in last month’s update. Investors can opt for profit booking for the current month or reinvest proceeds yet again.

Disclosure: The author held Bitcoin at the time of press.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article