Ethereum Sheds Weak Hands, Resumes Uptrend to $2,600

Key Takeaways

- Ethereum recently reached a new all-time high of $2,212.

- While the number of ETH held on exchanges dropped to a three-year low, the potential downswing has vanished.

- As long as Ether holds above $2,050, there is a high probability of reaching $2,600.

Ethereum is back in the green after shaking out weak hands. Continued buying pressure could push ETH towards a new all-time high.

Shakeout Before the Breakout

After breaking out of a symmetrical triangle on Mar. 31, Ethereum surged by nearly 16% to a peak of $2,160. The upswing was met with a significant spike in profit-taking that resulted in a 10.70% pullback.

Many overleveraged traders were caught by surprise as nearly $230 million worth of long ETH positions were liquidated across the board.

The massive losses caused panic among market participants as the sentiment towards Ether dropped to its lowest levels recorded since the beginning of the year.

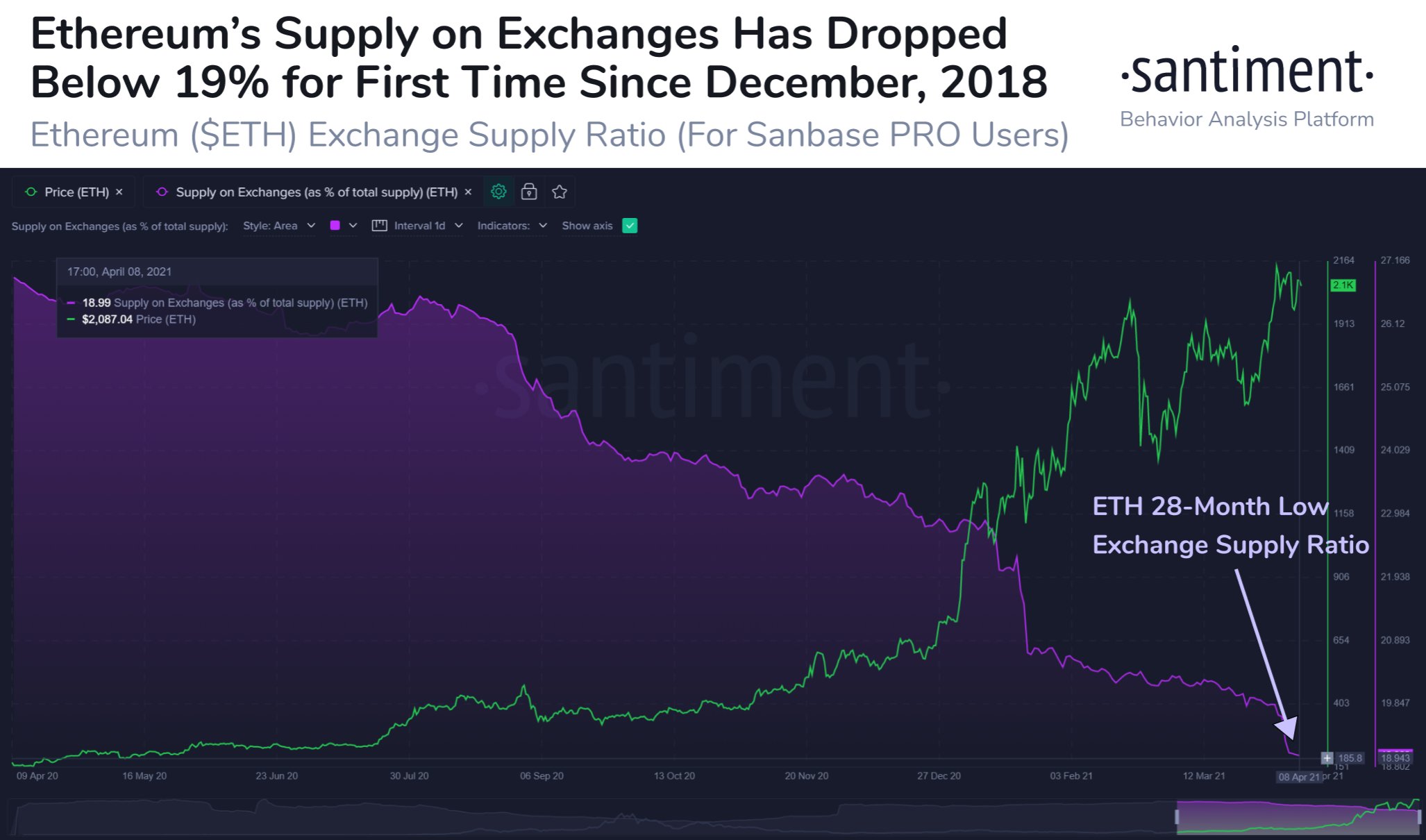

Savvy traders have since implemented this counter-sentiment trading strategy. Santiment recorded a substantial decrease in the number of Ether tokens held on exchanges throughout the most recent correction.

The behavior analytics platform suggested that such market behavior would likely diminish Ethereum’s downside potential and lead to another upswing.

“The amount of Ethereum sitting on exchanges continues to drop lower, as more and more funds move into hard wallets and DeFi-based options. This is a good sign for ETH holders, as less exchange supply implies a decreased likelihood of major sell-offs,” said Santiment.

Ethereum’s Uptrend Resumes

Interestingly, Ethereum kicked off Saturday, Apr. 10, on the right foot, getting back on track to reach its upside potential. The smart contracts giant shot up by 7% since the daily open, making a new all-time high of $2,212.

Based on the height of the symmetrical triangle’s y-axis, Ether has more room to go up. This technical formation estimates that ETH could rise another 15% toward the 141.1% or 161.8% Fibonacci retracement level.

These potential bullish targets sit at $2,480 and $2,720, respectively.

It is worth noting that as long as Ethereum holds above the $2,050 support level, the odds will continue to favor the bulls. Failing to do so could trigger another downswing to the 78.6% Fibonacci retracement level at $1,860 before the uptrend resumes.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article