Litecoin Surges Then Crashes on Fake Walmart News

Key Takeaways

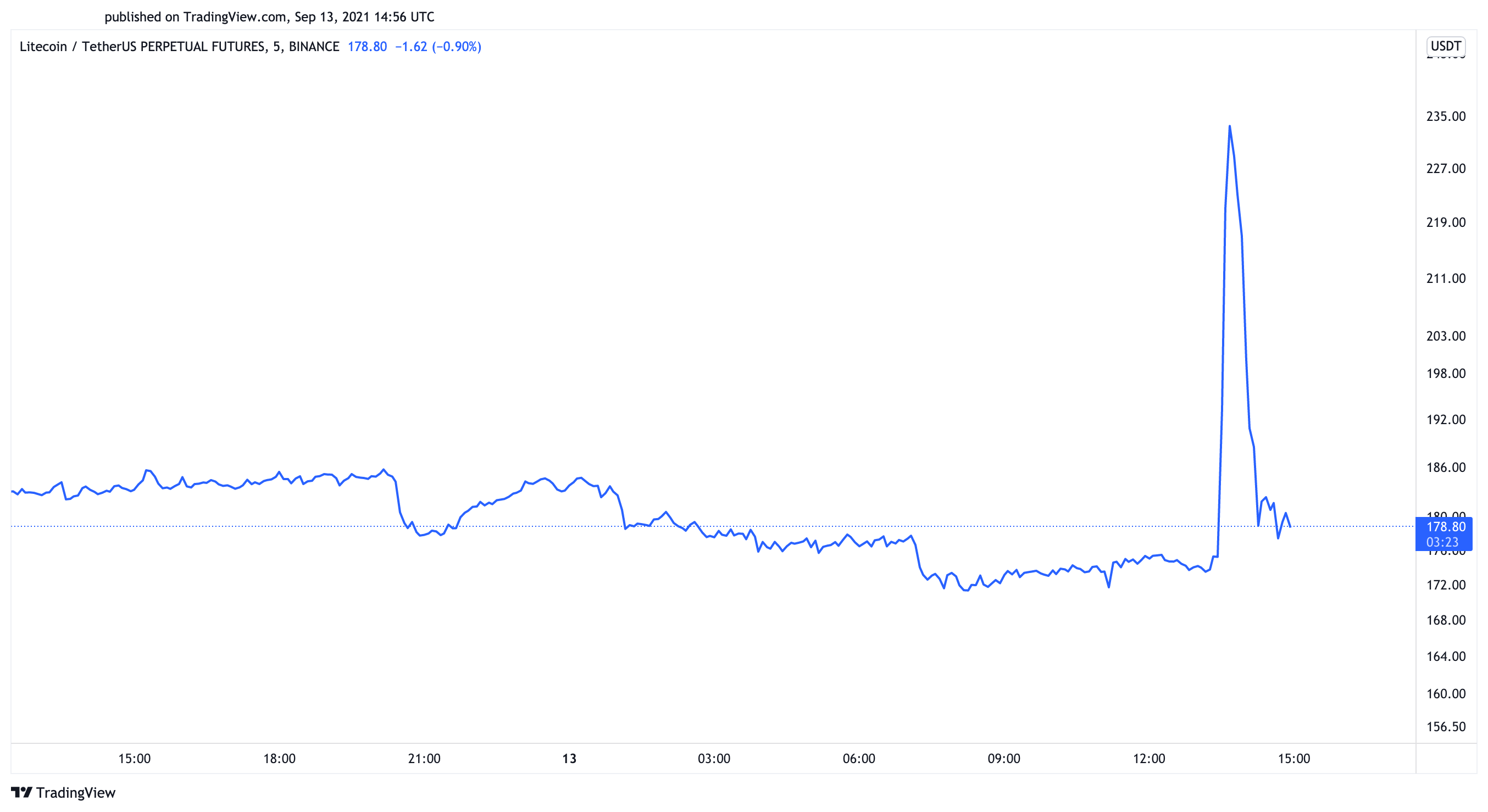

- Litecoin surged by more than 35% then crashed today after a fake Walmart partnership announcement surfaced online.

- The Litecoin Foundation and a spokesperson for the project have since debunked the news.

- On-chain data shows that LTC is stuck within stiff support and resistance.

Market participants rushed to exchanges to buy Litecoin today after a press release claimed that Walmart was partnering with the asset. The news turned out to be fake, resulting in significant losses.

Fake Press Release Sparks Litecoin Pump and Dump

Litecoin just went through one of the most vicious pumps and dumps of the year.

The number 14 cryptocurrency by market cap saw its price jump by 35% today after a press release referencing a partnership with Walmart surfaced online. A tweet from the official Litecoin Twitter account also appeared to confirm the news, but it was abruptly deleted. A spokesperson from the multinational retail corporation has since confirmed that the announcement was fake. The Litecoin Foundation has also debunked the rumors.

A sell-off ensued when it became clear that the press release was fake. LTC quickly shed all the gains incurred within minutes and retraced towards $174.

Data from Bybt shows that Litecoin’s erratic price action caused over $25 million worth of liquidations of long and short positions. While some cryptocurrency enthusiasts tremble with fear, others wonder where LTC is heading next.

Litecoin Stuck in Limbo

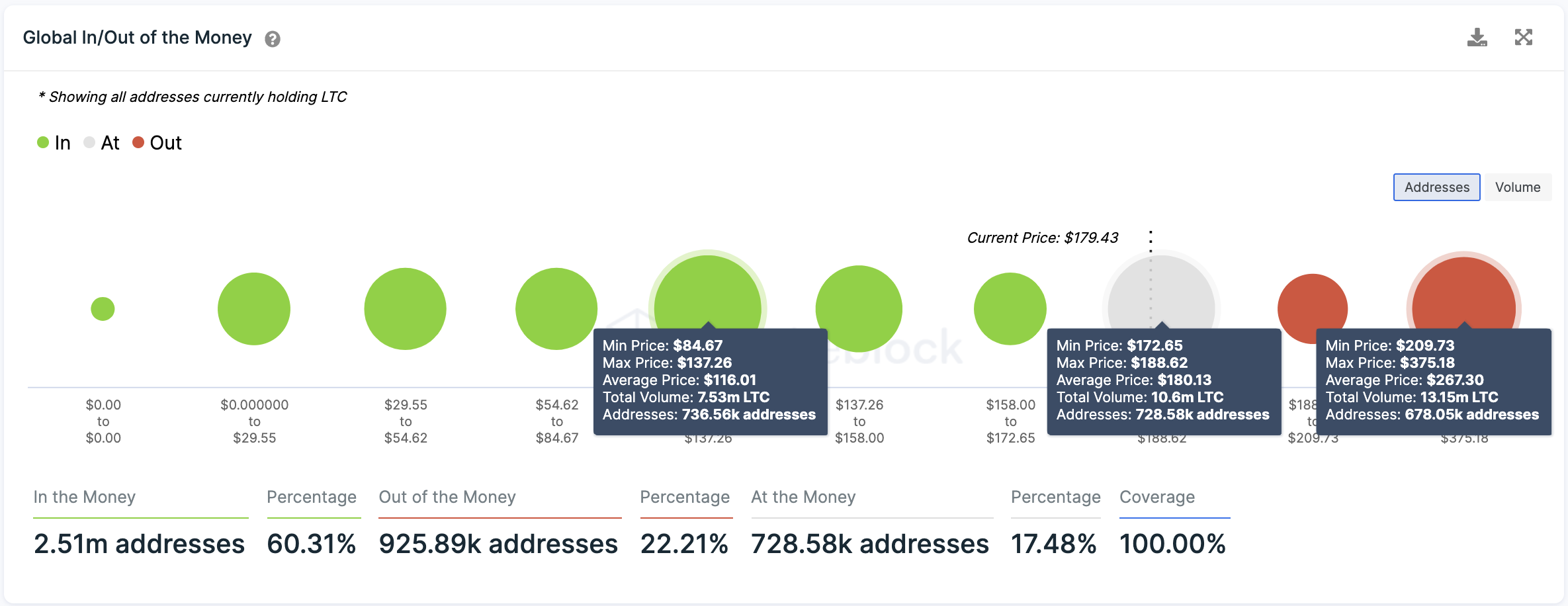

Transaction history reveals that Litecoin is currently trading within a significant interest area. Based on IntoTheBlock’s Global In/Out of the Money (GIOM), nearly 730,000 addresses had previously purchased over 10 million LTC between $172.85 and $188.62.

Only a daily candlestick close outside of this price range will determine where the asset will head next.

Slicing through the $188.62 resistance could encourage investors to buy more tokens, pushing prices towards the next supply barrier at $267.30. On the other hand, a spike in selling pressure that pushes LTC below the $172.65 support level could lead to a downswing to $116.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article