XOH On Why Now is the Best Time to Start a Brokerage–& How to Do It

When it comes to financial markets, the start of the year 2021 looks very different from the start of 2020.

After the COVID-19 pandemic wreaked havoc on global society, financial markets saw a lot of big changes: huge fluctuations in stock prices toward the beginning of the year sent the world into panic. Shortly after, an influx of new traders came onto the scene.

Additionally, throughout the year, cryptocurrencies saw a major boost–eventually ending the year with a new set of all-time highs across the board.

For trading providers, these trends have presented big challenges and big opportunities. Recently, Finance Magnates sat down with Jan Kotowksi, who serves as an international business developer at trading solution provider X Open Hub (XOH).

Jan spoke to us about how trading providers (and those who wish to become trading providers) can take advantage of these possible opportunities and build a brokerage at this unique time in history.

The following is an excerpt that has been edited for clarity and length. To hear the rest of Finance Magnates’ interview with X Open Hub (XOH), visit us on Soundcloud or Youtube. This is a sponsored episode.

Market trends: As 2021 begins, financial trading is more popular than ever

We asked Jan about the trends that have taken over the ways that traders engage with financial markets over the past year.

First and foremost, Jan said that the usage of mobile devices has become extremely important: “on the one hand, it’s a very good thing; on the other hand, it’s very demanding,” he said.

“It’s very good because traders can have access to their portfolios at any time and from any place in the world.” However, for the same reason, mobile access to portfolios is challenging from a provider point of view.

“At the same time, I find that trading itself has started to be cost-effective,” Jan added. This has brought an influx of new traders into financial markets.

This widened base of new kinds of traders is also hungry for “new classes of financial assets,” such as cryptocurrencies.

Perhaps this is why there has never been a better time to found a brokerage–a service that XOH specializes in.

What is X Open Hub (XOH)?

“Our mother company was founded in 2002; we, X Open Hub (XOH), were started in 2012,” Jan said. “We started as an operator of institutional liquidity clients, and then, in 2013, we started to provide a branded platform known as XOH Trader.”

“In 2013, after just one year, we had locked in twenty new business clients for our firm. In 2016, we introduced the next version of our cutting-edge platform; it also showed great results, and the news of how good our services are beginning to spread.”

As a result, “we had gained another 100 clients by 2018,” and so XOH has been responsible for more than 30 percent of the income of the XTB group since 2017.

“Back in 2020–which was actually the greatest year so far for both XOH and XTB–we were happy to count over 200 clients for XOH, which equated to more than 35 percent of XTB’s revenue for the year.”

“Currently, we are focusing on our core business, which is offering the liquidity solutions and technological solutions as well as some other business-management tools.”

New companies must be prepared for large customers

“If you are a brokerage and you are starting a business–particularly if you are a new firm without a big capital group behind you–it’s quite common that as you develop, you will gather some new, big clients. For some companies, this is a good thing. However, for other companies, this can bring trouble, because big customers mean big volumes.”

Therefore, if you happen to be a small firm without a lot of resources, “at some point, you can’t take care of everything yourself. Additionally, regulatory bodies sometimes require you to forward transactions to a third party.”

“This is where XOH comes in,” Jan said. “Our liquidity solution is actually where you would forward that customer’s orders for another institution to hedge your own risk as well as their positions.”

“This is demanding technologically, because the whole world is developing really fast, especially in the internet and digital connections industry. Our partners and their customers are very much aware of this. Therefore, everyone requires a solution that is low-cost, has fluent execution, and access to the markets 24/7.”

This kind of trading environment “creates a lot of challenges for the brokerages themselves as well as us as the liquidity partner.”

Scalable solutions for companies of all shapes and sizes

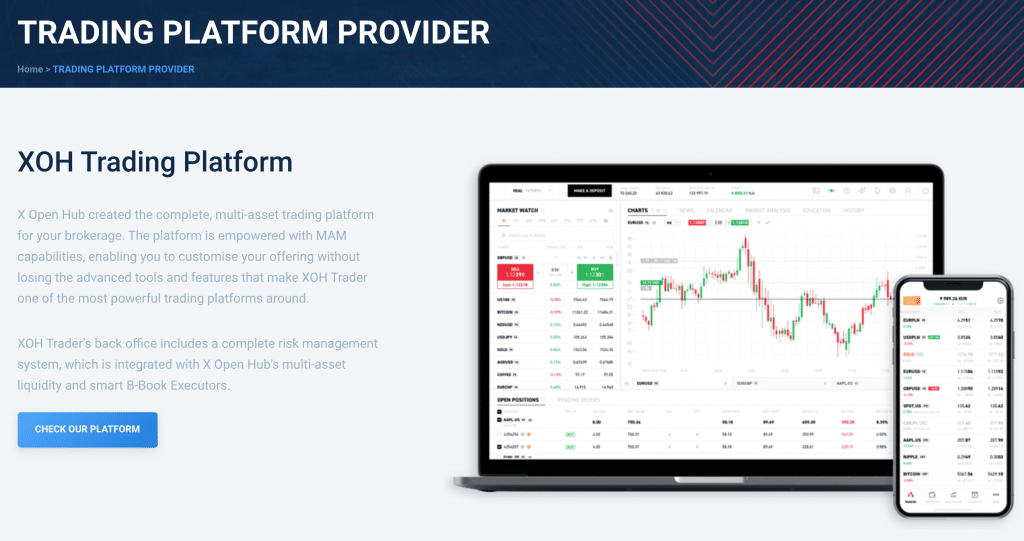

XOH’s other product offering, XOH Trader, is a “very light and user-friendly platform” compared to similar solutions that are currently available on the market.

The offer is aimed toward “mid-sized businesses from all over the world,” Jan said, adding that “currently, we have clients from almost every continent.”

The clientele also includes banks and small companies from developing countries that are entering the market for the first time. Jan said that XOH also offers technical support that is available at scale for each of these unique clients.

“All of the key analytical functions that you may desire; it’s very user-friendly in terms of learning the platform. Basically, you can click on it and experiment with it for one hour, and then you will be pretty fluent with it.”

Also, “despite the platform’s resourcefulness, it’s not very heavy on the bandwidth. This is important for partners based in parts of Africa or Asia where most of their clients will be using mobile connections.”

Indeed, “when you are operating on a mobile platform, you want to have a stable connection, and also you don’t want to have unnecessarily large amounts of data coming to the device you are using. The lower the bandwidth that’s required, the lower the probability of mistakes, troubles, and distortions in data-based functions. This is very important.”

Jan added that XOH is actively working on developing the platform further, and that “we’re also working on the future version of it in new programming languages, which will also be even more user and business-friendly in the upcoming years.”

Setup time: “usually, the longest stage of our clients’ setup has to do with regulatory approval.”

Jan also said that the amount of time needed to use XOH Trader to open a fully operational brokerage is typically much less than the amount of time that’s needed with competitors’ solutions.

“Usually, the longest stage of our clients’ setup has to do with regulatory approval,” he said.

“Our solution really accelerates the whole process and makes it easier for small and mid-sized partners,” he said. “For big institutions, there is a great financial group behind us that supports the stability of our solutions, as well as hedges the risks associated with operating a global platform.”

Jan also said that XOH Trader could be particularly well-suited for companies that are seeking to grow their user base in developing countries.

“First of all, the solution is very sound,” he said. “Basically, with the back-office applications that manage the platform, our partner brokerages have everything there on their table. They don’t need to think how to connect CRM with some platform, with some other hedging or technical solution–it’s all in one place.”

A wide range of trading instruments is important for all brokerages, particularly those in developing countries

Additionally, “we provide access to APIs so that if someone wants to integrate some other system with us, it’s actually pretty simple. The manual is written in a way that provides the entire coding language that the platform uses.”

“There is also a possibility to use a wide range of instruments, which is particularly important for markets in developing countries,” he said. “Right now, we offer over 4,500 instruments, including stocks.”

This offering also includes synthetic stocks: “for businesses, we offer mostly synthetic instruments,” Jan said.

“This is important from a regulatory standpoint because most regulators require extra safety measures when it comes to trading. With a synthetic stock, you basically have a CFD instrument that is behaving exactly like a stock–you can adjust the dividends, and so on. The only difference is that you don’t physically own any share in the company, and you do not have access to shareholder rights.”

“This is very attractive for new businesses that are marketing themselves as companies with really wide offerings and access to virtually every financial activity the world has to offer.”

Additional features

Jan also explained that the marketing side of the XOH Trader solution is advanced, and that customers of the solution have access to some of X Open Hub’s marketing resources.

“For example, if you want to have feedback about market-related news and our feedback is available in your language, you can have it as well,” he said. Additionally, “if you want some training or some automated solutions, we have other partners who are providing these solutions, and we can provide connections to those partners.”

Finally, the platform is “very customizable”–Jan said that “we offer white-label solutions” that allow customers to implement their own logos, news feeds, and training programs. “You can make it happen with us.”

This is an excerpt that has been edited for clarity and length. To hear the rest of Finance Magnates’ interview with X Open Hub (XOH), visit us on Soundcloud or Youtube. This is a sponsored episode.

Source: Read Full Article