GM under Barra will sell more than cars and trucks as automaker targets trillions in new markets

- The Detroit automaker's innovation division has identified $1.3 trillion in new market opportunities that it believes complements its core business.

- GM's majority-owned autonomous vehicle unit Cruise is vying for what executives say could be an $8 trillion market in the future.

- The company's also dipping its toes into urban air mobility, which it predicts will be a more than $1 trillion market of its own.

In this article

- GM

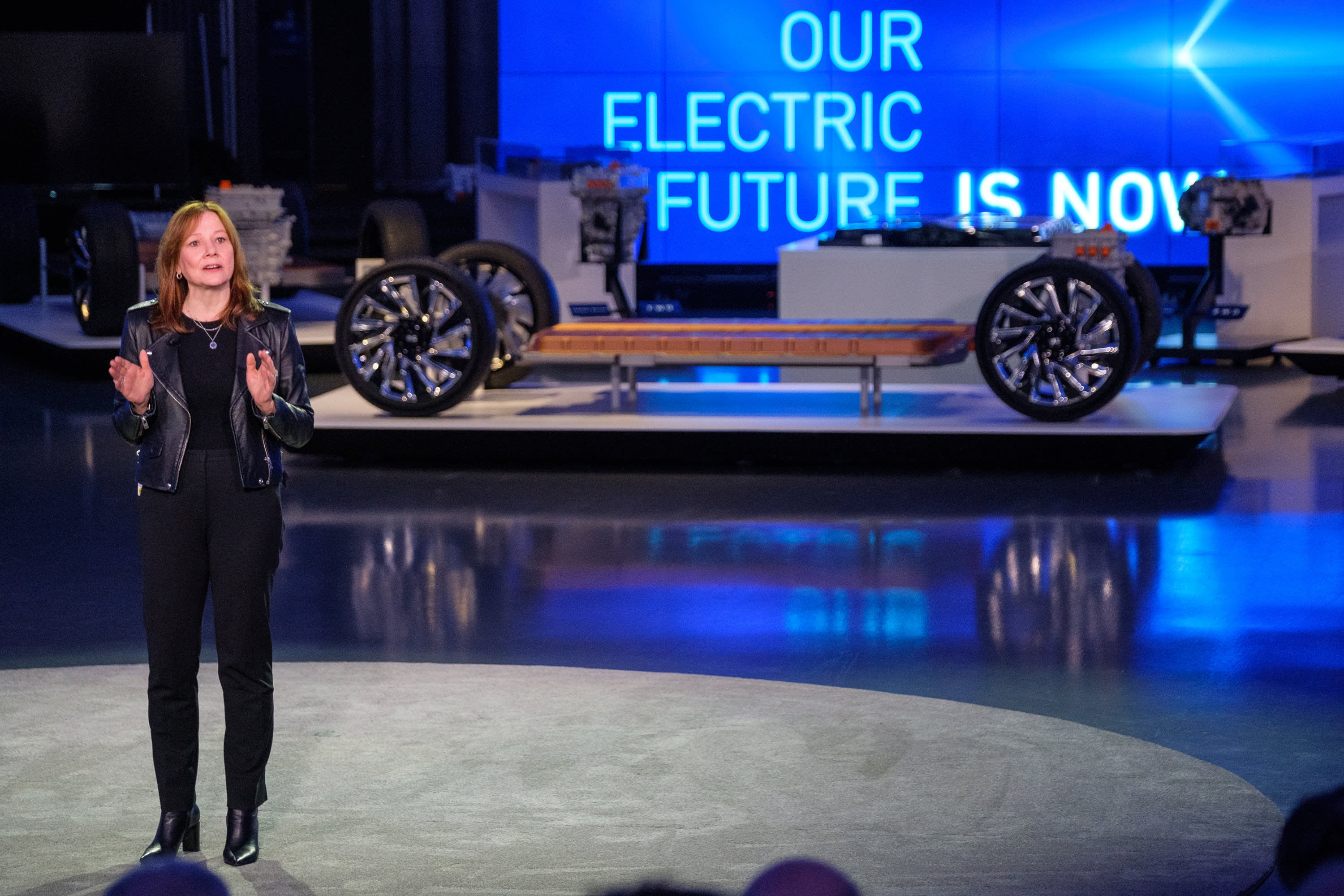

DETROIT — Since taking over the helm of General Motors in 2014, CEO Mary Barra has meticulously cut costs, slashed about 64,000 jobs, exited unprofitable markets overseas and audaciously pledged to make GM an all-electric auto company by 2035.

Though controversial at times, each of those decisions took GM one step closer to where it is today: poised for growth in new markets.

Barra's GM looks vastly different from the one she inherited out of the financial crisis. Leveraging its core business, GM is targeting trillions in future markets that stretch far beyond just selling cars and trucks.

"This is just the beginning for the next generation of General Motors," Barra told investors Wednesday during GM's first-quarter earnings call. "We are well on track with our plans to transform our company and lead the industry into the future."

Leading much of the expansion is GM's global growth and innovation team. New businesses from the team have included electric commercial vehicles, auto insurance, military defense and expanding services of its connected OnStar brand, with more new ventures on the way.

$1.3 trillion

The Detroit automaker's innovation division has identified $1.3 trillion in new market opportunities that it believes complements its core business and it has a right to "win in," executives told CNBC. That does not include GM's majority-owned autonomous vehicle unit Cruise, which could be an $8 trillion market in the future, or urban air mobility, which it predicts will be a more than $1 trillion market of its own.

"Our whole goal is to grow the [total addressable market] through utilizing existing GM assets, know-how, IP where we have existing capabilities to solve new problems for maybe customers we have now, maybe customers that we don't have now," Pam Fletcher, GM vice president of global innovation, said during a video interview.

The expansion plans, if successful, would alter how the company makes money and could help temper the boom-and-bust cycles of the automotive industry. GM would rely more on recurring revenue from software and services rather than simply producing and selling vehicles.

GM's innovation team has about 20 initiatives in its pipeline that target that $1.3 trillion in potential new markets, according to Alan Wexler, GM's senior vice president of innovation and growth.

Wexler said the team is evaluating urban air mobility — think flying cars and taxis — for the mid-2030s as well as more sustainable businesses such as recycling electric vehicle batteries to use as power generators.

The mission is to have the innovation unit, which was created in 2018, serve as a start-up incubator within the automaker, allowing each business to move more quickly than GM traditionally has. Wexler describes the end goal as creating a company that will be radically different from what it is today.

"I think the most exciting thing and the reason why I'm here is we're creating a company that doesn't exist in the world, and frankly we're creating an industry that doesn't exist in the world, and we're doing it for the sake of people on the planet," he said during a video interview.

Global growth strategy

Both Wexler, former CEO of consulting firm Publicis Sapient, as well as Fletcher, a GM veteran, have been tasked by Barra to lead the automaker's growth into new segments.

So far, the innovation division has launched a military defense unit and a new commercial EV business called BrightDrop and expanded GM's decades-old OnStar connectivity brand into insurance, vehicle logistics and security services.

"What we're focused on doing here is to set the context for everything that we do," Wexler said. "We're not looking at the sideview or the rearview mirror, if I can use an auto analogy. We're really looking toward the future."

Barra told investors this week that GM remains fully committed to investing in its new businesses as well as EVs despite the coronavirus pandemic and an ongoing global shortage of semiconductor chips.

"The challenges we have with semiconductors right now are a temporary situation," she said. "We will work through that and move beyond it, and it's not impacting our transformation and growth strategy."

Barra's intentions to reimagine the company largely began publicly in 2017, when the company acquired Cruise and launched mobility initiatives such as its now defunct Maven mobility brand. It did so while making significant cuts to its business operations, including exiting Europe, Russia and other markets.

Read more

"When you look at our core business, it is truly the foundation for the transformative opportunities that are right in front of us," Barra told investors during a Barclays conference in November 2017. Later she added: "Make no mistake, we are here to win." That desire to "win" is a guiding principle along with the company's "triple zero" vision to eliminate crashes, emissions and congestion with products developed by its innovation team, according to Fletcher. "We always want to do more faster, but I think we've got a lot of great things in motion and that are going to be game-changing for people," she said. The new initiatives, coupled with GM's plan to become an all-electric vehicle company by 2035, have led shares of the company to recent record highs. "I like all the verticals they're pursuing," Morningstar analyst David Whiston told CNBC. "I don't think they're frivolous science projects or anything like that." He said many of the businesses could have "a lot of upside" that's probably not being priced in to its stock because it's early and it's unclear just how big they could become. Morgan Stanley analyst Adam Jonas called GM a "SPACtopus" because of its new business units addressing many sectors of an influx of start-up companies going public through reverse mergers with special purpose acquisition companies, also known as SPACs. In an investor note, Jonas called the businesses "hidden gems," including some more traditional business operations such as Corvette, Cadillac and its financial arm. Bank of America Global Research analyst John Murphy described the new business units, specifically BrightDrop, as proof GM "has class-leading technology internally to compete" against SPACs in a note earlier this year. He told investors that the new verticals could be "separated and monetized over time." GM's stock is up more than 160% during the past year. Shares are at more than $57, up about 38% so far this year. Its market cap is about $84 billion. Barra said Wednesday the company will host a meeting this fall focused on its futuristic growth initiatives. "We'll use this event to go deeper into our growth strategy and financial opportunities and everything that drives them, including software, hardware and services along with our strong brands," Barra said. — CNBC's Michael Bloom contributed to this report. Source: Read Full Article'A lot of upside'