LIC’s Adani Investment: ‘Policyholders’ Money Is Absolutely Safe’

‘LIC has not sold any Adani shares to suffer real loss.’

‘LIC has made notional profit in the case of Adani shares because the investment is about Rs 35,000 crore.’

‘The value of it even today is Rs 56,000 crores.’

Should LIC policy holders and investors be worried by the battering of Adani group stocks on the stock exchange following the US-based short seller Hindenburg Research’s report? The Life Insurance Corporation is reported to have invested significantly in the Adani group.

The LIC issued a statement earlier this week, saying it had invested less than 1% of its total AUM (Assets Under Management) in the Adani group.

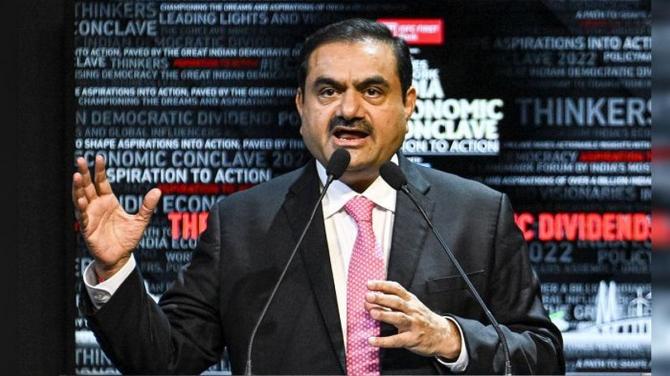

Rediff.com‘s Shobha Warrier asked Amanulla Khan, former president, All India Insurance Employees Association, if LIC policy holders need to be alarmed by the corporation’s Adani investment.

The LIC says it has invested less than 1% of its total AUM in the Adani group. Still, it is more than Rs 35,000 crore (Rs 350 billion). Should people be concerned?

I will answer in two parts. One is, Adani is the perfect example of crony capitalism in India. As an organisation, we have no doubt about it.

We also agree that the Hindenburg report has asked some very valid questions.

As an organisation, we want the government to order an enquiry and find out the truth as it is important for the Indian economy.

It’s necessary to have a fair enquiry to give assurance to investors in LIC.

We are also concerned why SEBI has not been reacting. SEBI also should find out the truth.

We are opposed to the way the growth of Adani has taken place.

It’s a clear case of political patronage helping an individual grow.

The next aspect is Adani’s impact on LIC.

LIC has made it very clear that it has certain concerns about the Hindenburg report.

As the largest investor, it has the right to question both Hindenburg and also the response of Adani on certain findings.

We welcome this position of LIC.

Now, the investment policy of LIC is that 80% of its investment are in secured deposits, that is in government securities, bonds, etc.

The rest of the 20%, LIC invests in equities. And LIC is a long term investor.

So, investment decisions are taken keeping in mind whatever is beneficial to policyholders in long-term.

LIC has an investment board, and the decisions on investment are taken by the board after a thorough scrutiny.

Regarding the investment in the Adani group, what people are talking about is only a notional loss as the market value has come down, and not in real terms.

LIC has not sold any Adani shares in the market to suffer the real loss.

LIC also has made notional profit in the case of Adani shares because the investment is about Rs 35,000 crore.

The value of it even today is Rs 56,000 crores. So, there is no loss notionally. There is no profit also notionally.

The question of whether LIC suffered losses or gains comes only when LIC divests the shares in the market. Right now, it is only notional.

When we spoke earlier, you had said the government’s decision to sell LIC shares affected people’s trust in LIC. Do you think this situation will also affect the trust and confidence of people in LIC?

There are two issues here. LIC has got a large corpus to be invested.

Every year, LIC generates a surplus of Rs 4.5 lakh crore-Rs 5 lakh crores. Where do you invest? You cannot keep the money idle.

If you keep it idle, you cannot give returns to the policyholders. So, it has to be invested, and invested prudently.

Is it wise to invest so much money in one group?

In the case of the Adani group, the total exposure is only about 7% of the total equities investment done.

It is much larger if you look at the Reliance group. Even in some of the public sector banks, it is much larger.

Even though the amount of Rs 35,000 crore appears big, it is a small amount compared to the annual surplus LIC generates.

LIC had come under public scrutiny many times before.

When LIC purchased ONGC shares, the campaign was that LIC was pumping money to payload the government. But we have made a clean profit in the ONGC shares.

When we purchased IDBI Bank shares, it was a loss making bank. So, there was a lot of criticism. But today, we are making profit out of IDBI Bank.

The difference between LIC and the other investors is that LIC is a long-term investor.

On the other hand, banks cannot invest for a long term.

Let me tell you, the policyholders’ money is absolutely safe. Because our solvency ratio is much more than what is required. And all the liabilities of the corporation are covered by the assets.

I am not talking about the market value of the assets, but the book value.

So, there is absolutely no need for people to panic. Their money will remain safe.

Is investing in the Adani group a political rather than economic decision?

The fact is LIC is also an institution that promotes capitalism and the institution is under the control of the ruling classes. So, they will utilise it to promote their own interest.

But as a trade union and as a public body, our job is to ensure that wherever LIC makes the investment, the benefit should come to society at large.

There should also be total safety of policyholders’ money.

Looking at the way the economy reacted to the fall of Adani shares, is it not alarming to see the kind of influence one business group has on the Indian economy?

Yes, it is alarming. It is alarming for more than one sense; that a large part of the Indian economy, the infrastructure projects — from ports to airports are owned by one individual’s company.

There is no transparency in governance, and that is the basic question to raise. We also told LIC to raise this question.

It is a matter everybody should be worried about; not just LIC, but every Indian should be worried about the monopoly of economy that is taking place.

Because of this kind of economic model, huge inequality is taking place in the country.

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article