China is Leading the Wealth: 5 out of the World’s Top 10 Cryptocurrency Billionaires Originate from the Country

The Chinese crypto community seems to flourish, as judged by the number of billionaires that are the country’s natives. Indeed, half of the top 10 richest crypto owners originate from the Communist Republic.

Although characterized by harsh government policies, China is an important player in the field of cryptocurrency and blockchain technology. Today, the Communist country leads the way in Central Bank Digital Currency (CBDC) development, with pilot projects progressing well, according to reports by CoinIdol, a world blockchain news outlet.

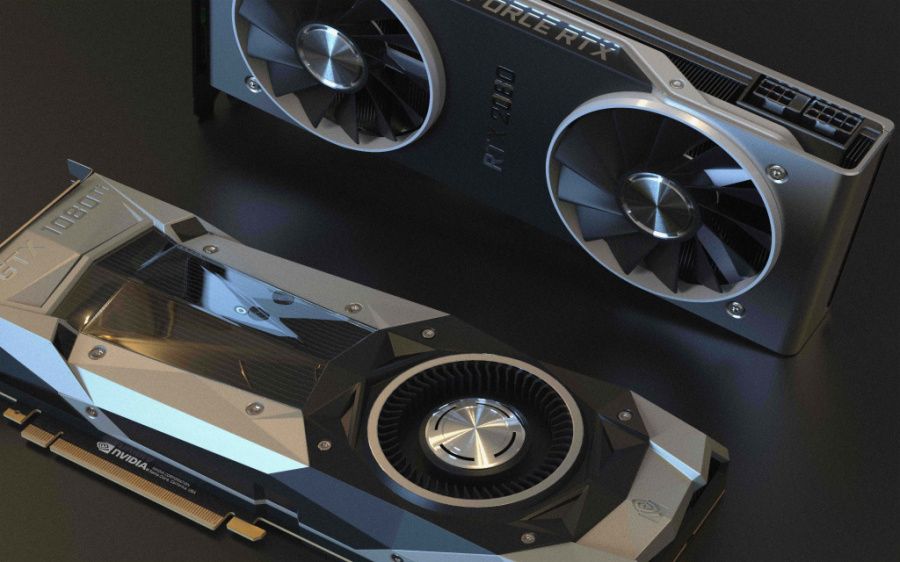

In the field of crypto mining, China is still doing pretty well—research revealed that more than 65 per cent of total bitcoin mining happened in China in April 2020. Moreover, this coincided with the time when the coronavirus pandemic was at its peak.

The Chinese crypto whales

A new study by Traders of Crypto reveals the world’s top 10 largest owners of cryptocurrency, but the list keeps changing as the crypto community grows. The stories of some of the crypto heavyweights attribute success in the crypto world to several factors including trading experience, prior wealth and passion but it is interesting that according to the study, half of the whales in the “crypto ocean” are Chinese.

Top of the list, was, of course, Satoshi Nakamoto, the pseudonymous bitcoin founder whose nationality is thought to be Japanese and believed to own at least one million bitcoins. However, it is still a bit problematic to verify information about Satoshi Nakamoto due to anonymity.

Second on the list is 42-year-old Micree Zhan who is a Chinese electronics engineer and renowned entrepreneur. Zhan who is also the co-founder of Bitmain, the largest computer chip company for crypto mining was first named the richest bitcoin holder in 2018. As of June 2019, Zhan’s net worth was estimated at US$5.42 billion.

The third crypto giant is Changpeng Zhao, Binance’s founder, presently worth about $2.6 billion. Binance is the world’s largest crypto exchange.

Another Chinese crypto monster is a 34-year-old Jihan Wu, who also happens to be the co-founder of Bitmain. Wu was among the 2020 Asia’s youngest billionaires with a total net worth of $1.8 billion. Bitmain presently maintains Antpool, which holds the largest hashrate and now controls at least 16% of the world’s total blocks mined.

Finally, the other two bitcoin hulks of Chinese nationality are Mingxing Xu and Li Lin, who are both worth $1.4 billion and $1.1 billion respectively.

The table also mentions United States’ 60-year-old Chris Larsen worth about $2.7 billion, Cameroon & Taylor Winklevoss ($1.4 billion) and Tim Draper ($1.1 billion).

Why China dominates the list of crypto rich

China accounts for 65% of the global bitcoin mining. In comparison, the US only claims 7% of the mining capacity.

One major reason for this is the cheap coal energy supply. Inner Mongolia, a city North of the country, due to its abundance of energy supply mines the most bitcoins in China. Consequently, Inner Mongolia has not met its energy targets for a while now. Additionally, the cheap labour supply in the country has reduced operational costs of crypto firms, while the high level of electronics manufacturing has availed mining equipment to the Chinese at competitive prices, hence, maximizing their profits. Finally, some Chinese provinces like Sichuan have subsidized electricity costs to favour crypto mining.

Overall, China is the centre of the crypto revolution in the Asia-Pacific region with the most crypto billionaires in the world. However, the government has lately cracked down on bitcoin and generally crypto mining to save the environment and save its digital yuan project from the competition of private and anonymous digital currencies.

While crypto activities have always prospered amid difficult government regulations, the government’s interest in inventing its own digital currency might lead to “unfair” competition between crypto and CBDC.

Source: Read Full Article