Ripple’s Chief Legal Officer Makes Three Predictions About Crypto Regulation in the U.S. in 2024

In December 2020, the U.S. Securities and Exchange Commission (SEC) initiated a lawsuit against Ripple Labs (and two of its executives, Bradley Garlinghouse and Christian A. Larsen), which centered around the allegation that Ripple conducted an unregistered securities offering through its sale of XRP, a digital asset. This case has been a significant point of focus in the crypto industry due to its potential implications for classifying and regulating cryptocurrencies.

The SEC claimed that Ripple and its leaders unlawfully offered and sold securities, which breached Section 5 of the Securities Act of 1933. The SEC further accused Garlinghouse and Larsen of aiding and abetting these violations committed by Ripple.

On the other side, Ripple Labs said that XRP is a currency and not a security, thus falling outside the SEC’s jurisdiction. Ripple argued that XRP has been functioning as a part of its decentralized network and is used for transactions and liquidity in cross-border payments, differentiating it from traditional securities.

On 13 July 2023, Hon. Analisa Torres, a district judge at the United States District Court for the Southern District of New York, gave her ruling in the SEC v. Ripple Labs lawsuit. Both parties had submitted their summary judgment motions to the court. After reviewing the case, the court made a decision, partially granting and partially denying the motions from both the SEC and Ripple and its executives.

According to the ruling, the court granted the SEC’s motion for summary judgment concerning the Institutional Sales but denied it for other matters. On the other hand, the court granted Ripple’s motion for summary judgment regarding the Programmatic Sales, the Other Distributions, and the sales made by Larsen and Garlinghouse. However, the court denied Ripple’s motion concerning the Institutional Sales. As for the SEC’s motion for summary judgment on the aiding and abetting claim against Larsen and Garlinghouse, it was DENIED.

On 19 October 2023, Ripple announced that its CEO, Brad Garlinghouse, and Executive Chairman, Chris Larsen, were absolved of all allegations made by the U.S. Securities and Exchange Commission (SEC). The SEC decided to drop all charges definitively, marking a significant retreat by the agency.

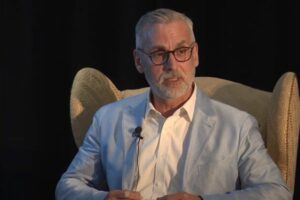

In a series of notable predictions made on 15 December 2023, Ripple’s Chief Legal Officer, Stuart Alderoty, shed light on the potential trajectory of cryptocurrency regulation in the United States for the year 2024. His insights provide a glimpse into the expected legal and regulatory developments in the crypto sector.

Closure of Ripple’s Legal Battle and Continued SEC Enforcement

Alderoty anticipates the final resolution of Ripple’s ongoing legal dispute with the U.S. Securities and Exchange Commission (SEC) in 2024. He suggests that while this prolonged lawsuit against Ripple will conclude, the SEC is expected to maintain its aggressive stance. This approach, described by Alderoty as “regulation by enforcement,” is predicted to persist, with the SEC likely targeting other prominent players in the cryptocurrency industry. This reflects a continuing trend of the SEC employing enforcement actions as a primary tool for regulating the crypto market.

Judicial Checks on SEC Overreach and Potential Supreme Court Involvement

Further, Alderoty envisions an increasingly critical role for the judiciary in curbing what he deems as the SEC’s overreach. He forecasts that judges will consistently act as a crucial barrier against excessive SEC actions. Alderoty predicts that 2024 will witness the SEC suffering significant defeats in court cases, potentially paving the way for a showdown in the U.S. Supreme Court. These judicial outcomes could set influential precedents, shaping the regulatory environment for cryptocurrencies.

Congressional Agreement and Action Paralysis

On the legislative front, Alderoty predicts a consensus in principle among U.S. lawmakers regarding the need for crypto regulation. However, he foresees a lack of agreement on the specific course of action. According to Alderoty, this discord is expected to result in a standstill for U.S. crypto firms. As a consequence, while American companies face regulatory uncertainty and stagnation, Alderoty suggests that other countries will make significant and positive strides in the crypto domain. He believes that this divergence could potentially place U.S. firms at a competitive disadvantage in the global arena.

Source: Read Full Article