Bitcoin Price Under Bearish Overturn

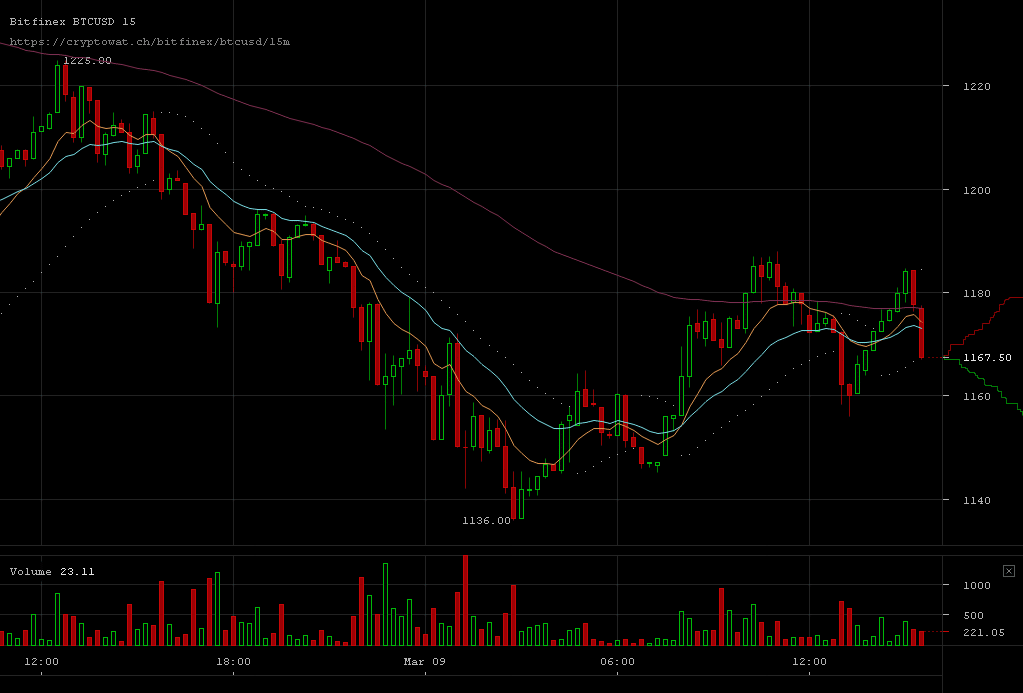

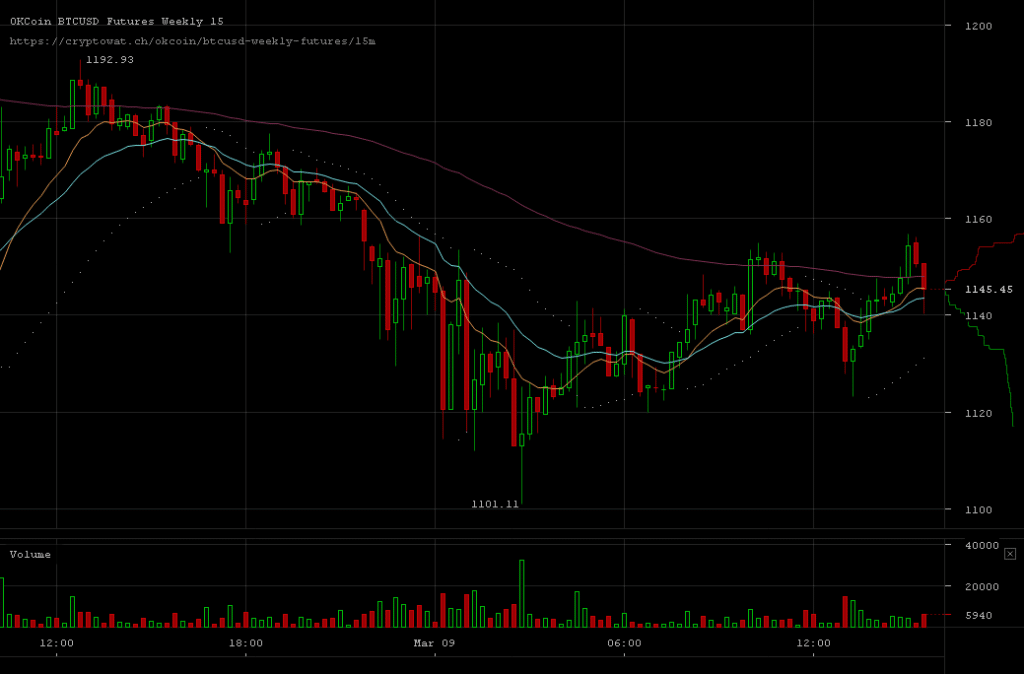

Bitcoin markets have been giving into the selling pressure promotes by profit taking that pressured BTC/USD markets to going lowed through preceding trading sessions. The recent fall in bitcoin rates has left bitcoin prices under a staggering fall that neared 4% in the last few hours, while large back to back sell orders are still dominating markets.

Major Signals

- Selling pressure is showing astounding strength as the end of the rally might have been marked in the minds of traders

- Trading volumes have grown exponentially from one day to another, showcasing how strong selling pressure remains even after support levels were broken

- A return back above $1200 levels keeps feeling more unlikely through time as resistance levels have already been established whilst support remains weakened

Overall, the market’s movements though the last few trading sessions are certainly not as positive as believers in the rally’s potential would like to have it. The recent fall might be perceived as a correction but at the same time goes to show that markets were ready to accept a price fall after the rally’s end was marked.

Source: Read Full Article